Stocks have been moving down recently, and none more so than Oil & Gas companies. Lots of names in the industry are trading at just half their 52 week highs. The reason often given in the news is forecast lower global demand for oil which is being interpreted as bearish for stocks in general. However it has, in mine and others opinion, more to do with the big increase in supply and production from North America predicted in the future. The USA is on track to become the largest producer of oil in the world.

Saudi Arabia (the current largest producer) has been scaling back production for the last couple of years to keep the price of oil high, but it seems they are tired of being the only country in the OPEC cartel to take a hit in terms of production to keep prices elevated, so they have opened the taps and privately stated their intention to continue regardless of whether oil prices fall significantly.

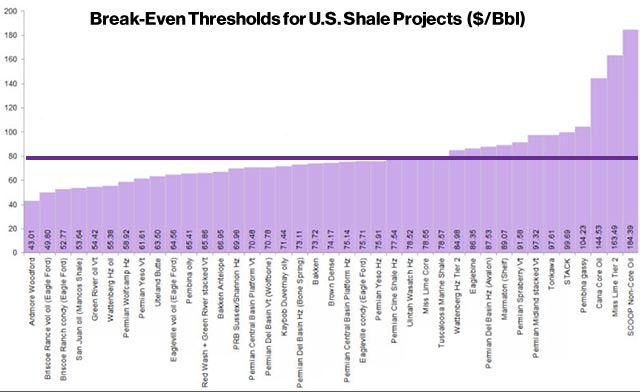

Some think this is a tactic to force other cartel countries to scale back production with them, hence will last a year or two before production is scaled back again to lift the price of oil. I won’t pretend to know what their intentions are, but there is one thing which is certain – a lot of North American producers can survive with oil less than $80 a barrel and a lot can’t.

According to industry reports, such as this one, some oil producers such as those in Alberta oil sands in Canada, even need oil up to $150 per barrel to be economical.

Still, there are others that have very high netbacks (i.e. costs per barrel to produce are low), so it seems a good time to go bargain hunting for the most economical producers that may be trading at depressed prices due to industry pessimism.

Evaluating Oil Companies

One of the most basic things to look for with oil companies is whether production is light oil or heavy oil. The former is much cheaper to produce, so companies with mostly light reserves will be the lowest cost producers.

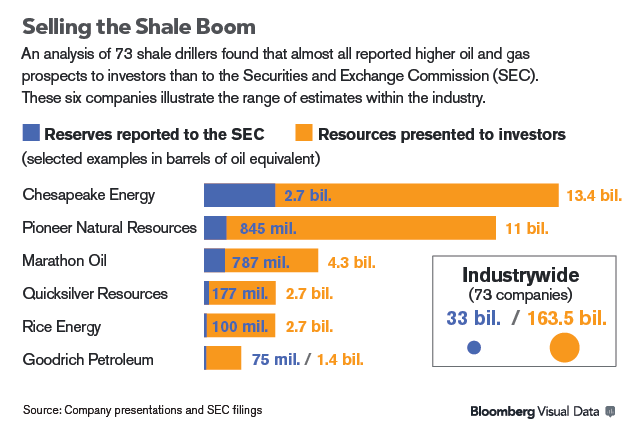

One has to be careful when analzing these companies though, especially junior producers. This Bloomberg article highlights some of the dangers – companies overstating their reserves to investors. This isn’t unique to junior explorers either, even some big names do it.

The point to take from this is to always compare presentations with regulatory filings, and to always use the filings when valuing the business.

Legacy Oil – Stock Analysis

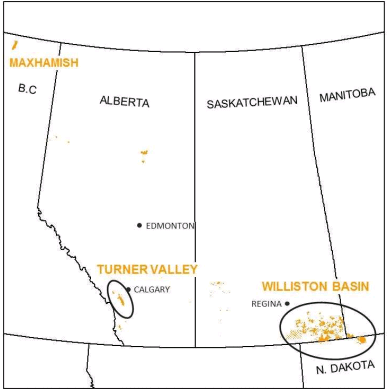

My hunt for low-cost oil plays in North America soon brought me to Legacy Oil as it seems to be held in high regard on various message boards. Legacy’s key oil and natural gas properties are located within two core geographical areas consisting of the Williston Basin and Turner Valley. In addition, Legacy has an emerging light oil resource play at Maxhamish, British Columbia.

My hunt for low-cost oil plays in North America soon brought me to Legacy Oil as it seems to be held in high regard on various message boards. Legacy’s key oil and natural gas properties are located within two core geographical areas consisting of the Williston Basin and Turner Valley. In addition, Legacy has an emerging light oil resource play at Maxhamish, British Columbia.

You can view the company’s investor presentation here, as well as the most recent Annual Information Form. I was quite impressed by the presentation for a number of reasons. Firstly, while it gives estimates of reserves beyond its regulatory filings, it clearly indicates which are 2P reserves and which aren’t. Secondly it puts most emphasis on per share measures, which indicates a shareholder minded management. This is especially important with companies that do a lot of acquisitions (of which Legacy is one) because too often executives will pursue expensive acquisitions to increase company assets but at a detriment to individual shareholders. Before diving into these measures I first want to highlight Legacy’s revenue breakdown, which shows it is largely light & medium crude oil (the cheapest to produce).

As a result, Legacy has some of the highest netbacks in the industry. It spells these out in its regulatory filings, and I have also included data from 2010 to show that Legacy can remain very profitable at oil prices even below $80 a barrel.

Management History

Management is very important for smaller oil producers, especially if like Legacy they don’t pay a dividend and profits are reinvested back into the business. Drilling new wells is usually highly profitable with costs recouped in just 1-2 years. Managements can waste money however on acquisitions and exploration. But Legacy has a decent history of increasing value for shareholders, the graph below shows various per share metrics.

The investor presentation does flatter their record, showing reserves and production increasing per share, but not showing there has also been a significant increase in debt per share. The PV10 (Net present value of proven oil reserves after tax, discounted at 10%) has increased over time, but Net PV10 (PV10 – debt) has not seen the same increases.

PV10

If you aren’t familiar with PV10, I suggest reading my How to value an oil company series. I like the PV10 metric as it gives investors a good baseline value, and as it’s based on proved reserves only, it doesn’t rely on optimistic projections. Currently the Net-PV10 of Legacy is around $4 per share (exact number isn’t known as PV10 was last given before 2 large acquisitions). The shares currently trade at $4.90 which at first seems like a bargain, as PV10 does not even include probable or possible oil reserves, of which Legacy has significant amounts. Also most of Legacy’s proven reserves are already producing so don’t require large capital investments or risk new well failures. But a PV10 figure is only as good as its underlying assumptions, of which the main influencer is the price of oil.

Oil Prices

The graph below shows the assumptions Legacy used in calculating its PV10.

Oil has been hitting new lows for weeks, and Legacy’s forecasts are looking optimistic, that is why Legacy shares, and oil producers in general have been hitting new lows along with it. As I write WTI crude oil has stabilized just above $80 a barrel after briefly dropping below it last week.

Some reports have suggested that on average, North American oil is profitable as low as US$63-$70, and that this even applies to some producers in the Alberta oil sands which are usually thought of as high cost. With the large supply increase, the market is forecasting a new bear market in oil, signalling the end of the last 14 year bull market. Historically we have seem this before, with bear markets lasting decades. Here are the costs of various new North American oil sources.

Source: Bloomberg

The OPEC cartel however is not as fortunate as the North Americans. While their production costs are low, their states rely on the large revenues from the export of oil. Reports suggest that the Saudis need Brent crude oil at $90 to balance their budget. They have said they will endure low oil prices rather than reduce supply and lose market share, but they can’t do that indefinitely, as it would lead to deep cuts in public spending which could result in revolution against the monarchy.

Financial Sensitivity

I don’t know where oil prices will be in 1, 2 or 5 years, but I can try to test Legacy’s sensitivity to changes in the oil price. Oil producers are leveraged bets on oil for two reasons. Firstly operating costs are fixed so changes in the price of oil have a magnified effect on income. Secondly, when the companies have debt, this further magnifies their sensitivity to oil.

Take for example a company selling for an Enterprise value of $1bn, $500m debt and $500m equity. If oil prices fall so that the company is only worth $900m, as the debt is fixed this 10% reduction in EV translates to a 20% reduction in the value of equity, to $400m.

Legacy had netbacks of around CAD$50 per barrel in 2013 at realized (mainly Edmonton) oil prices of around CAD$92 (equates to roughly US$90 WTI). If the WTI price of oil falls to $70, that $20 reduction falls entirely on netbacks, reducing them to roughly $30 i.e. a 40% reduction in cash flow. If we reduce PV10 by 40% to $4.93 per share, net debt is unchanged, hence net-PV10 falls from $4 per share to just $0.32 per share. Is $70 oil a worst case scenario, or could oil go to $60? And for how long? Legacy is forecasting high oil prices from 2017 onwards.

There is another worrying aspect of Legacy’s projections. They are forecasting Edmonton Crude, which current trades at about a $10-15 discount to WTI, will trade at a much smaller discount in the future. Note the table below from the company’s filing (Edmonton Par is quoted in CAD$). For example in 2016 it is worth US$80, only a $4 discount to WTI.

This makes no sense, since the Edmonton (Canadian) price relies heavily on demand from the USA, and exports are projected to fall (and have already started to do so) as US production grows. This will put more downward pressure on the Edmonton price compared to WTI.

My conclusion is that Legacy’s PV10 does not in itself give investors downside protection, in bad scenarios it will merely go to paying off the debt leaving little for equity holders. If however one believes that $90-100 WTI oil is likely in the future then Legacy is an attractive stock based just on PV10.

Other reserves

But Legacy has more to it than proven reserves. Firstly it has probable reserves, that have a net present value of $3.95 per share (based on the same assumptions above) according to the last annual information form. As these only have a 50% probability of recovery I will discount them by 50%, and a further 40% to stress test for a fall in oil prices. That gives a rough final value of $1.19 per share.

Waterflood potential

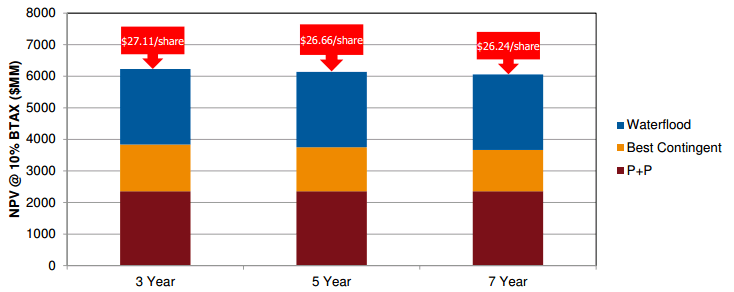

Legacy also has potential beyond its P+P (proven and probable) reserves.

Waterflooding is a relatively cheap way of increasing reserves and production, typically costing $5-10 per barrel and can dramatically increase reserves by pumping water into underground formations to force more oil out. Legacy has a chart on potential increased reserves from waterflooding, though these are not included in regulatory filings. Here is an article on the process for more information.

The reserves and NPV figures should be taken with a pinch of salt, but do demonstrate that it could result in a significant increase in reserves and PV10, as well as an increase in production from the wells. The ‘contingent’ reserves are best ignored in my opinion, because by definition there is a reason they cannot be commercially developed.

I do have my doubts about the waterflood NPVs though. Progress is slow, Legacy has been piloting waterflood since December 2011 and has since released impressive trial results showing an increase in production of over 2.5x in most cases. But in 2014 the waterflood developments have slowed and we are yet to see a large scale roll out. Whether that is due to cash restraints or actual performance being below managements suggestions we can’t be sure, but it is strange that the process gives such stellar results yet 3 years since first piloting it we aren’t really any closer to realizing all this ‘potential value’ for shareholders. For something they are claiming can double NPV that doesn’t quite make sense.

Legacy boasts it has “…inventory of 2000 light wells and waterflood assets” which represents 15 years of future developments. If that is accurate then Legacy has a lot of growth still to come, but it isn’t clear how many of these rely on waterflood and how many are part of ‘contingent’ reserves.

Concluding thoughts

Legacy is definitely one of the better Oil & Gas producers, it is low cost and has a competent management that do seem focused on shareholder value. This industry has a reputation for scams, unscrupulous managements and heavy investor losses, and that is a deserved reputation as there are a lot of people happy to take ‘dumb money’ from unwitting investors.

That said, although Legacy is among the best, the share price doesn’t quite meet the level of ‘distressed’ that I had hoped for when I started looking at oil co’s. Under pessimistic conditions the downside here isn’t protected in my opinion and upside relies a lot on managements projections of contingent and waterflooding reserves to be accurate.

I should be clear that these pessimistic conditions are not ones that I am forecasting, or that I even think are likely. If I had to make a bet it would be that oil is around $90 in the future, at which point Legacy appears to be a good investment with a lot of upside. The risk/reward here is compelling, but I’m not naive enough to put any faith in my own oil price forecasts (read: guesses). For those with more faith, Legacy is worth a look.

Disclosure: Author has no position in LEG.TO