Last week Warren Buffett was frank on CNBC and admitted that he made a mistake investing in Tesco ($TSCO.L). It’s hard to argue with him, shares in Tesco have gone only one way since he first invested in them in 2007.

I myself am among the unlucky Tesco shareholders, however was fortunate in early 2013 to realize my folly and sell almost all my shares (and even make a small profit). Though Tesco made many obvious mistakes such as its failed entry into the US market, it is actually its home market, the UK, which has contributed to its disastrous share price performance. I think the tale of Tesco highlights some important areas of danger that investors often fall foul of, particularly relying on financial metrics while giving too little thought to qualitative factors of a company and how it does business.

The best in class

Let’s travel back to 2007, when Tesco was the undisputed champion of the UK supermarket industry.

Let’s travel back to 2007, when Tesco was the undisputed champion of the UK supermarket industry.

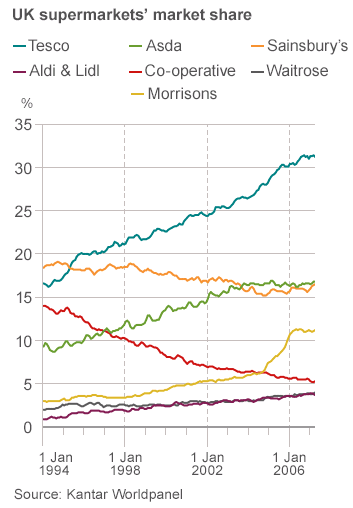

For the previous 10 years Tesco had grown to become the biggest retailer in the UK, with twice the market share of its nearest rivals, which included Asda – Walmart’s UK chain.

There were several ways it did this. Firstly it had a very successful model of buying land, building a Tesco superstore, then selling the property (at a big profit) to free cash for the next development. This allowed rapid expansion.

It also operated a clubcard scheme where customers would accrue points by shopping at Tesco which they could exchange for money off vouchers or other treats such as cinema tickets.

Brand loyalty was high, with Tesco stores offering more than food; they had expanded into electronics, clothes, games, CDs and DVDs. Tesco had been aggressive and decimated the existing games, CD and DVD retailers who were barely profitable and would not survive the 2008 recession.

Tesco was equally ruthless with its suppliers. Providing food for over 30% of the UK population, it used this enormous buying power to squeeze every penny from suppliers. This led to it having the highest profit margins of any supermarket. This, coupled with its asset light model of operations, also gave it the best returns on equity in the industry.

By all quantitative measures and financial ratios, Tesco was the strongest supermarket in the UK, and a safe place to park money as a long term investment.

Strong future

And Tesco wasn’t just the best in raw financials, it was also the leader in a changing industry. In 2007 online retail was in its early days for groceries, but it was growing fast. Tesco was one of the first to launch its own grocery delivery service, where customers could shop online and have it delivered the next day.

This was also the start of a profound shift in consumer shopping habits. Large superstores were becoming less and less popular as customers switched to online orders for bulk shopping and relied on smaller more local shops for fresh produce. Tesco again were the leaders of the industry and rapidly expanded smaller, local stores in central locations. To make it clear how early they seized onto this trend, Morrison’s and Waitrose only launched small store formats in 2013.

In summary: Tesco was a dominant player in one of the most stable industries and moreover was the leader of that industry. It was investing in the infrastructure it would need to appeal to future shopping habits and had plenty of competitive advantages:

- Biggest buying power and hence best economies of scale in the industry

- Best profit margins in the industry

- Best returns on equity in the industry

What happened?

You may be confused now, I have painted an incredibly bullish picture of Tesco, yet I said this was a case study about a failing retailer, so shouldn’t I be pointing out all the bad things, the warning signs, that Buffett should have seen? Well no, there is no point in hiding the fact Tesco represented a very attractive investment in 2007, and anyone pointing out its flaws and saying you could have avoided disaster by looking at X and Y is (I believe) not being very honest. The only warning signs I can see are those with the benefit of hindsight and by being an actual customer of the supermarket. In fact if you had compared Tesco and Walmart in 2007, you would notice many similarities and would think Tesco was a safe bet. Walmart has done very well, Tesco hasn’t.

So let me try to explain the current problems Tesco are facing; UK supermarkets compete(d) fiercely with one another. They all want to convince the customer they are the cheapest, to get them into the door. All of the large players operated with the same model – advertise popular items at cheap prices, even sell them at a loss, to get people in the door. Everything about Tesco’s color scheme and branding gives the impression of cheapness.  But once they are in the door, you wring every last penny from them.

But once they are in the door, you wring every last penny from them.

One of the most popular methods were BOGOF (buy one get one free) offers on items – make customers want to buy more than they actually need. But then you run into a problem, giving items away free hurts margins. Luckily supermarkets solved this problem by simply increasing the price for a week, then doing a BOGOF offer shortly after. It is a great scam strategy to increase profit margins while appearing to be great value to customers.

Warren Buffett, reading Tesco’s annual report in the US probably thought everything was going well, Tesco had industry leading margins and high returns on equity. But what he didn’t see was that customers were arguably being manipulated and in some cases, blatantly deceived, into purchasing items they wouldn’t ordinarily buy.

Fall from grace

The recession had an impact on shopping habits in the UK, consumers suddenly were prepared to shop around to find the cheapest grocery prices, and even visit multiple supermarkets to do shopping – on the same day. It was the beginning of an ‘enlightening’ period where the customers wised up to the tricks of the big retailers. What’s more, a couple of smaller supermarket players were given a chance by customers, who found that not only were they cheaper, but they sold produce at constant low prices, with no confusing offers. This was the catalyst for a media and public revolt against the pricing tactics of the likes of Tesco.

But it isn’t just pricing tactics that have gone against Tesco, it is also the service to customers. I used (note – past tense) Tesco’s online shopping service for years and while initially satisfactory, I soon noted that almost every delivery was late, and items were frequently not available and substituted with an alternative. I changed to online-only retailer Ocado and have never looked back. And the problems weren’t just confined to the online business. In 2008 Tesco was ranked among the bottom supermarkets in customer satisfaction. By 2012 it was the worst. Tesco’s high profit margins were apparently coming at the expense of customer experience.

Dangerous extrapolation

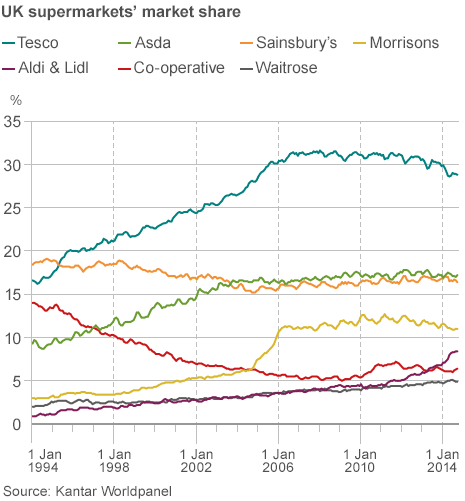

Humans have a bad habit of extrapolating historical trends to predict the future. It is a habit we as investors must fight in order to keep an objective outlook. Take a look again at the market share chart above, and how you may extrapolate those lines. The chart below is what actually happened.

The future is always uncertain and a lot of quantitative analysis is only based on historical data. That is fine, it is very useful information, but we must also think about the qualitative and intangible factors affecting a business and how these can change the future.

Conclusion

Warren Buffett says he made a mistake with Tesco. But was it an avoidable mistake? Well I honestly don’t think it was in 2007, a quantitative analysis showed a very strong company, and qualitative factors were also in its favor.

However, shareholders had all of 2010 and 2011 to exit this investment at only a small loss. During these years, Tesco’s ratios and margins were still strong, but the qualitative factors such as customer experience were deteriorating. During this period I believe it was an avoidable mistake to hold, or even buy more shares.

So what can we learn from this case study? Well ask yourself these questions; how much do you really know about the businesses you own shares in? Do you know how satisfied their customers are? Do you know whether competitors offer a better service? Are they using any underhand tactics to maximize profits (this isn’t a rare occurrence), that will hurt the business if ever unveiled? Do you have firsthand experience with this business?

Peter Lynch always advised people to invest in what they know well, and one of the reasons this is good advice is because being a customer of a business gives you a unique insight into that company. Warren Buffett had a disadvantage with Tesco in that he couldn’t have firsthand experience of shopping there week after week. We all have that disadvantage with most publicly listed stocks, so we must be thorough in our due diligence and hold diverse portfolios to protect from the ‘unavoidable’ or ‘unlucky’ mistakes we make.

Disclosure: Author is long TSCO.L

Morrisons had same issue with their cellar business.

then they burnt their hands in kiddicare.

Overall,both of these supermarkets are heading towards disaster.

The small electric stores sale are booming due to their good customer friendly approach.I bought one mobile from tesco which developed a fault after unlocking was done officially by tesco mobile team.They washed their hands out citing lot of terms and i was out of pocket by 70 pounds.

If you buy at curry’s,sonic direct,richersounds then experience is totally different.microwave broken- get new one straightaway as part of their insurance policies.

who cares about tesco

They won’t be able to recover their market share for cleaning products as 99pstore,homebargains,b&m,etc have mushroomed everywhere.Why i will pay 4 pounds for a kitchen roll when same brand is available at bargain stores for 2 pounds.