The readership of this blog is quite varied both in geographical terms, but also I think in investment experience. Many people that manage their own money don’t actually have any formal qualifications in finance. So I’m sure many readers will respond the same way I did some time ago when I asked a friend what was he doing his Masters dissertation on and he replied ‘Dark pools’ – by pulling a confused grimace. I think it’s worth introducing these pools to those of you that know little or nothing about them (but I will say right here that I am far from an expert on the subject).

My friend introduced me to a world that surprisingly no one really talks about unless they have studied finance or know someone that has. I occasionally catch a reference to ‘Dark Pools’ on TV but it’s rare, even on programs about investing.

In my early days as an investor I was quite lucky to happen across The Intelligent Investor by Ben Graham and went on to read many books referred to by Warren Buffett – usually written over 50 years ago. There is a problem with getting your education from old textbooks though – you will get a naive view of how the stock market works today.

Most people are probably familiar with High Frequency Trading because it gets into the news a lot, but like Dark Pools, it didn’t exist 50 years ago and so typical value investing books will make little or no references to them. Even worse they give descriptions of the stock market that are very misleading when thinking of today’s markets. Retail investors imagine buying a stock as an order going through to a computer to say the New York Stock Exchange, where a market maker will buy or sell the shares (or some computerized version of that). Everyone’s orders come together, through an order book and move a stock price up or down. But the reality is that many trades never go through the NYSE, and investors have no way of knowing if someone is secretly selling or buying stock in the so called ‘dark pools’. Worst still, neither do the stock exchanges.

Dark Pools

Imagine a shadow stock exchange, but with no visible order book, secret orders that are only revealed on a delayed ticker tape (if revealed at all) and all you have is the bid/ask – which can be different from those quoted on the stock exchanges. Buy a million shares here and no one knows you’ve bought them – and the share price on the NYSE doesn’t move. This may sound like something you’d hear from some conspiracy theorist along with talk of the Illuminati – but it’s real. Welcome to the world of the institutional investors and the dark pools.

The rationale for these dark exchanges is fairly simple – big money managers move markets when they enter/exit positions. Entering positions will often take several days of buying on the regular stock exchanges, which drives up the price and hence is more expensive for them. A dark pool however can offer huge blocks of shares at much fairer prices. Plus, none of your competitors will know what you’re doing.

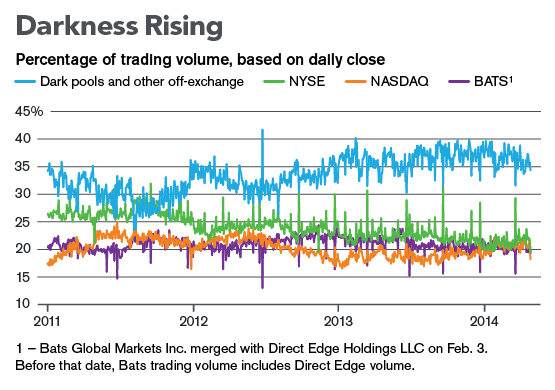

There are over 40 dark pools operating in the USA which are thought to cover 20-40% of all liquidity.

Source: Bloomberg

A lot of dark pools are run by banks, such as JPMorgan, Credit Suisse, Goldman Sachs etc. There are also some which are independently run, like Instinet. The industry started quite innocently, with brokers simply matching up clients that wanted to sell large blocks of shares with those that wished to buy them. This birth was in the 1980s when the SEC relaxed the regulations on brokers. Over time this has grown into something much bigger, a lot of orders going through dark exchanges now are relatively small in size. Dark pools usually offer lower transaction fees which adds to their appeal.

Why should you care?

So institutions get a fairer way to buy large amounts of shares, so what? Even if us mere mortals could access dark pools we are so small that there would likely be no difference in the price we paid surely? While that is correct, it becomes a problem when a significant proportion of a stocks liquidity is occurring in the dark pools. The free market price discovery process can no longer be deemed ‘fair’ and hence doesn’t represent the true market valuation of the stock. This can either present risks, or opportunities for the small investor.

Take for example a company with $100m market cap and 30% of the shares are traded in dark pools. Large shareholders could decide to dump their holdings using dark pools, but because these trades aren’t reported, the share price isn’t affected. If however this had been done on an open and transparent exchange the share price would move lower due to the selling pressure and the stocks ‘fair value’ as determined by the market would be different.

The regulators are all too aware of this problem and have taken actions to improve price discovery to include what is happening in the dark pools. Some claim there is no need, because all dark pool trades will affect the ‘lit’ stock exchanges in the end. After all if there is a large selling pressure in dark pools, then they cannot absorb them indefinitely and at some point must pass these shares onto the lit exchange to sell. But others remain unconvinced that everything evens itself out in reality.

Further reading

As you can imagine, my explanation here is a rather simplified version of a much more complicated and convoluted reality. If you are interested I would recommend further reading on the subject. Here are some good sources

I would also like to recommend Dark Pools by Scott Patterson

(http://www.amazon.com/Dark-Pools-Machine-Traders-Rigging/dp/0307887189)

Quite comprehensive IMO