This is a painful portfolio update for me, two of my holdings are down considerably and I’m sitting on losses not because of an error in judgement (I will happily admit I made errors but I had realized that) but because of greed. I risked a lot of money to make a further 1% on a trade. That greed for a fraction has cost me over 40% on each position. Lucky for me (or possibly due to intelligent position sizing), these positions were very small ones and haven’t cost my portfolio much. My pride has taken the brunt of the hit as opposed to my wallet. Hopefully by telling the tale of my woes readers will avoid similar pitfalls themselves.

Tesco

Let’s begin with a familiar face on this blog -Tesco ($TSCO.L). I’ve gone into detail about why the thesis on this investment was fundamentally flawed in the article ‘Why Buffett was wrong on Tesco‘ so I wont repeat it. I have been aware of this flaw for many months and back in June, when it was clear to me that Tesco was a poor prospect, I decided to sell the remainder of my shares. The share price was just under 300p, and down on the day. I thought I was being clever by setting my limit order at 300p which would ‘probably get hit in a couple of days’ and make me in the region of a 1% return than if I just sold at that moment. This 300p target wasn’t based on any estimate of fair value, it was based on nothing more than it had been 300p recently and I wanted to sell at a high – i.e. greed.

What happened? Well I paid a hefty price for that 1%, 300p never got hit and the shares are down 40% from where I could have hit sell.

If I think about what I have actually done, it is to risk a significant amount of money on a 1% return. This is not the kind of risk/reward that a value investor should be taking, we should be risking very little for more like a 100% return.

Awilco Drilling

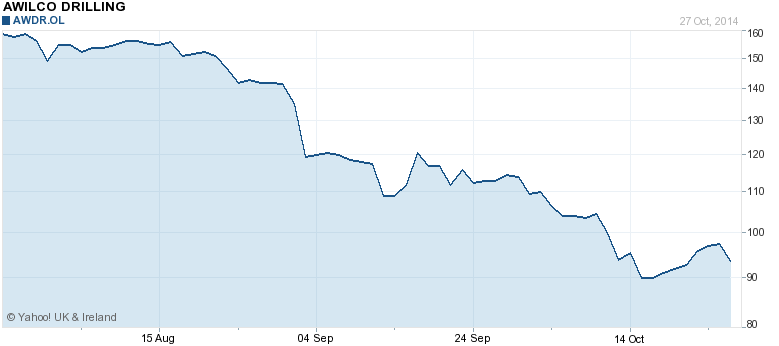

If only Tesco was a one off, and the end of it. But I made the same mistake with Awilco Drilling ($AWDR.OL). Back in August the price of Awilco approached 160 NOK and after reading their latest filings I became rather concerned that both rigs where due to go offline for maintenance soon, and the contracts they were under were expiring in a couple of years. The dividend yield had fallen yet those dividends would soon be under threat. I felt the risk/reward was no longer in my favor and decided to get out for a 50% return.

Unfortunately I let that green eyed monster creep in again and I set a limit order at 159. It had hit that price not long before and I wanted to get out at the high. What happened?….You guessed it….

My limit didn’t get hit and the share price has since fallen 59%. At this level I think the sell off is overdone and I am happy to hold. In the long term I expect this to be a good investment, but I missed a gifted opportunity to cash in early, not through an error in my reasoning, but due to greed for an extra 1%. I am livid at myself for such careless behavior and resolute that it will not happen again.

I hate to end a post on such a bitter note, so I have saved some good news for the end.

JD Sports

I am saying a sad goodbye to JD Sports ($JD.L), having sold the remainder of my holding. The performance of the JD business has been beyond anything I could have predicted when I first entered the position in April 2012. Net profit is up almost 50%, and like-for-like sales have been increasing in mid single digits every year, against a back drop of extremely tough competition in UK retail in general. Unfortunately JD’s other businesses (fashion retail and outdoor retail) have not been performing as well as the core JD brand. In my opinion the Outdoor segment should never have been bought (from bankruptcy) in 2012 and has just been a money sink.

I expect JD to go on and do well, but for me the risk/reward isn’t in the investors favor today. JD’s profits have improved greatly as like-for-like sale increases and operating leverage have expanded the bottom line. I estimate it will make a net profit of at least £65m this year – so with a market cap of £840m it certainly isn’t expensive. However operating leverage works both ways, and if JD’s fortunes take a turn for the worst, those profits will soon reduce, and they are the only thing justifying the current share price.

I am weary from watching and investing in retailers over the last few years, none last forever and I don’t want to push my luck with JD as consumer sentiment can change rapidly. At a P/E ratio of 13, JD looks about fairly valued, considering its free cash flow is below reported net profits. So I have decided to exit on a high and protect my portfolio from the pitfalls of retail. It also raises some much needed cash which now sits at 8% (still too low for my liking).

The JD position made 120% (36% annualized) which makes it my second most profitable investment ever. Let’s hope the good luck continues.

Disclosure: The author is long ADWR.OL, TSCO.L and has no position in JD.L

Funny thing, i do the same thing when i buy or sell shares. But i did not experience losses to this extent. I think it was Philip Fisher who adviced not to chase penny profits when we buy. This post reminded me that.

Thanks for the post and advice.