I came across Terra Energy (TSE:TT) on Reminiscences of a Stockblogger, a blog I recommend following if you don’t already. I was initially intrigued by the company and after reading this filing found that it was trading well below its PV10. PV10 is the future discounted cash flows that the company expects to receive from its proven oil and gas reserves. For more information on valuing Oil & Gas companies check out my series on How to value an oil company. The same methods apply to gas.

The company has an enterprise value of C$50.2m and PV10 of C$108m. And PV10 only includes proved reserves, it has additional probable and possible reserves on top of this. PV10 is my favoured way to value oil & gas companies as the hard work has already been done. Valuing based on exploration projects or areas of land owned is outside my area of expertise and I would only be speculating. Terra does have some interesting oil assets in this space and the post above goes into detail on them, I will leave that to people more qualified. But discounted cash flow models are one thing I am familiar with.

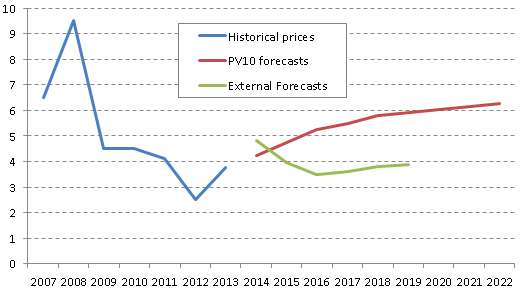

A company selling below its expected cash flows (after tax and expenses) may initially seem like a no brainer, but underneath the PV10 are assumptions about the price of natural gas which are critical, and that is going to be the focus of my post. Slight changes in prices result in drastically different valuations. I decided to check out what prices the company had forecast in the PV10 calculation and how this compared with historical prices and external forecasts, using the AECO spot price of natural gas. The chart below shows this comparison.

The external forecasts are sourced from Gas Alberta, I have no idea of their validity, accuracy or methodology but to me it seems like a plausible scenario and goes to possibly explain why the company is valued so far below PV10.

The external forecasts are roughly 2/3 of those used in the PV10, so in other words the revenue received will be 2/3 what the company expects if true. Luckily companies also provide undiscounted future revenues and profits expected, which for Terra was $550m on proved reserves for a profit of $181m. If I reduce revenue by 1/3, this wipes out $183m, and given costs wont change, profit is essentially now 0. I don’t need a calculator to work out that 0 discounted is 0. Suddenly that discount to PV10 doesn’t look large enough.

Conclusion

I don’t have any opinion on where natural gas prices will go in the future. If I was forced to make a bet, I would guess upwards not too dissimilar to the PV10 forecasts above, but the downside here is not protected in my opinion.

Still if anyone is particularly bullish on natural gas then Terra seems like a good opportunity to profit from that, the shares are easily worth triple what they currently trade at if the forecasts in the PV10 materialise.

Disclosure: TT – no position

Great work…and thanks for the education on PV10. I always like it when someone has already done the hard work.