Welcome back to the AIM IT Project, where I am going through and valuing all the investment companies listed on the Alternative Investment Market of the London Stock Exchange. This spreadsheet lists the companies covered so far and performance since.

Aurora Russia Limited (AIM:AURR)

Aurora Russia is a private equity fund with investments in 3 companies in Russia. It owns:

- £6.3m (24.3% ownership) Superstroy, one of the leading DIY retailers in Russia;

- £10.7m (26.0% ownership) of Unistream Bank, a leading Russian money transfer company; and

- £6.7m (100.0% ownership) of Flexinvest Bank which provides retail banking services.

- £7m in cash

Its story isn’t one of total failure like we often see in the AIM IT Project, but its not far off. The 2013 presentation of results gives us an insight into how the management works out the value of the businesses, based on multiples of EBITDA. Unfortunately the presentation shows also how sensitive these valuations are, all of them being significantly revised downwards in 2013. These revisions downwards continued in December 2013 when the company reported its interim results.

The company sold an investment recently for roughly 5x EBITDA. The company Superstroy holding is valued at an EV/EBITDA multiple of 5.3, Unistream at 40x profit before tax and Flexinvest at net asset value.

The fund appears to be looking to sell all its investments, and this is likely the reason for the repeated write-downs as it presumably is struggling to find a buyer in what is a tough market for private equity (in the non-Western world).

I’m going to value each component separately. Superstroy firstly looks to be carried at a fair value given its revenue and earnings growth over the last few years so I will leave that as it is. Unistream seems to me very over-valued and I will write it down to £3m. Flexinvest will likely be sold at a discount to book, 40% seems fair so I will value it at £4m. Finally cash is £7m pound for pound, so summing this I get a value of £20.3m, or 27.3p per share.

Share price: 21.25p

NAV per share: 40.7p

Valuation: 27.34p

Upside: 13%

Origo Partners (AIM:OPP)

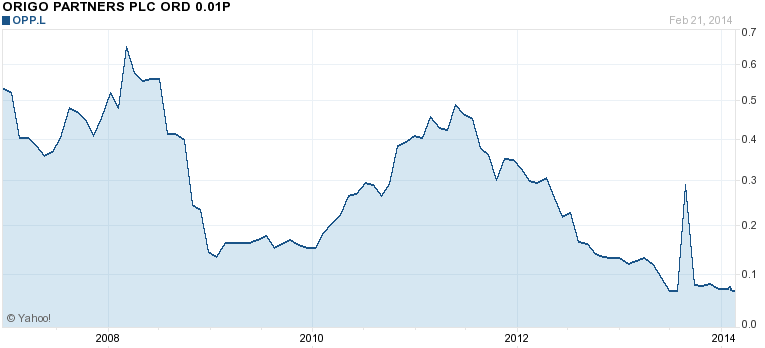

Origo is a private equity investment vehicle focussing on China, formed in 2009 through the merger of Origo Sino India and Origo Resource Partners. At the time the management restructured the groups investments from their existing areas into China. In 2011 the company raised more funds through equity and a convertible bond issue (more on this later). Since then however the company has struggled and now capital markets in China have dried up due to an increased focus on China’s risks. A chart of Origo’s share price since inception shows an all too familiar downward trend since 2011.

Reading the chief executives summary in the 2010 annual report, management seems to invest with a typical ‘top down’ philosophy relying on the economic growth of China and making significant investments in the resources sector. It’s not surprising then to see how the share price has performed given how the resource sector has been struggling of late and investors are generally pessimistic on China at the moment. I prefer a ‘bottom up’ investment philosophy, looking for individual companies at attractive valuations, regardless of the macro environment.

In 2010 they also note investments in ‘clean technology’, companies such as battery makers for electric cars and recycling companies – all with justification based on macro events.

In 2012 Net Asset Value fell by 29 per cent driven by the declining resource sector. It initiated a share buyback in 2012 given the weakness in the share price. Capital markets also dried up meaning it could not exit from positions that it wished to, one of the key risks of private equity. Underneath these headline figures however the ‘Cleantech’ investments did rather well, growing by 21%. Of course this is private equity and the company can just make up whatever valuation they like pretty much, and increase NAV accordingly (that’s why when market sentiment changes like it did with resources, the write-downs are very large, 40%+).

Its latest portfolio looks like this

- China Rice (27%) [valued by multiples]

- Gobi coal & Energy (21% of portfolio) [valued by DCF]

- Celadon Mining (20%) [valued by DCF]

- Unipower Battery (14%) [valued by multiples]

- China Cleantech Partners (12%)

- IRCA Holdings (10%) [valued by multiples]

- Niutech Energy (10%) [valued by multiples]

- Cash (3.3%)

- Others

There isn’t much publicly available information about these companies so it is difficult to say whether these investments are in fact worth their carrying value. The resources companies have had significant reductions in their carrying value already, a 50% decrease is all too common.

But there are a couple of things I like about this company. This is a quote from the 2012 annual report.

“Origo’s cleantech investments are not dependent on existing or continuing government subsidies going forward. We only consider investments in cleantech solutions and infrastructure that we believe can profitably deliver energy efficiencies and cost reductions without subsidies. This remains a fundamental point of differentiation across our portfolio of investments.”

I also quite like the performance incentive scheme, which pays out 20% of gains but only above a 10% return per annum hurdle.

Still, given the illiquid nature of the investments, and the fact that some of the portfolio (Cleantech) is likely valued at optimistic multiples I am going to give the portfolio a 40% haircut in my valuation, that reduces reported shareholders equity from $131m to $65m.

The company also has convertible preference shares, redeemable at $1.28 per share in March 2016, or convertible at a share price of $0.95. Conversion isn’t really a worry since the shares are now trading at only 6.5p, but the debt is carried on the balance sheet at $54m, yet the liability in 2016 will be $73m. I am therefore going to reduce my valuation by a further $19m to $46m (£27.6m) to account for this. This is equivalent to 7.9p per share.

Share Price: 6.5p

NAV per share: 22p

Valuation: 7.9p

Upside: 22%

Ingenious Media Active Capital (AIM:IMAC)

IMAC is a closed ended investment fund that invests (or used to invest) in media companies. The fund is winding down and returning cash to shareholders so isn’t actually that interesting. The latest NAV reported is 17.82p per share, of which 15.63p is cash. That may sound appealing compared to today’s share price of 7.25p, however the latest reported NAV doesn’t include a 10p per share dividend paid on 10th January 2014. Accounting for this the NAV is now 7.82p, only marginally above the current share price, and marked to market. So not much else to say on this and not of much interest to me, especially considering the bid/offer spread of 6.5-8.0p is enormous.

Share Price: 7.25p

NAV per share: 7.82p

Valuation: 7.82p

Upside: 8%

Disclosure: AURR, IMAC, OPP – no positions