Markel Corporation is an insurance company, and a well run one at that. I have talk about insurance previously in my Amlin (LSE:AML) article so I wont go into too much detail about how to value them, instead I’ll get straight into the numbers.

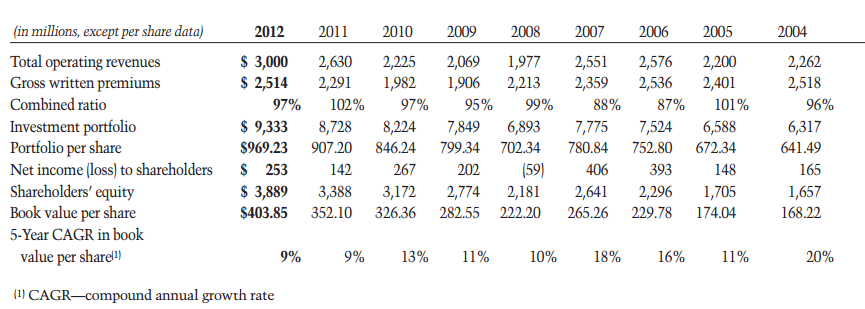

The two most important measures for me when looking at insurance companies is the combined ratio and growth in book value per share. The table below hows both.

(click to enlarge)

Since 2004 book value per share has grown at 11.6% compounded annually, which is a decent return. You can also see that the combined ratio has been less than 100% (i.e. underwriting is profitable) in all but two years. This shows a conservative writing of policies.

The stock trades at a Price/Book of 1.2, but due to a recent acquisition the Price/Tangible book is 1.4 which looks less cheap, but still interesting.

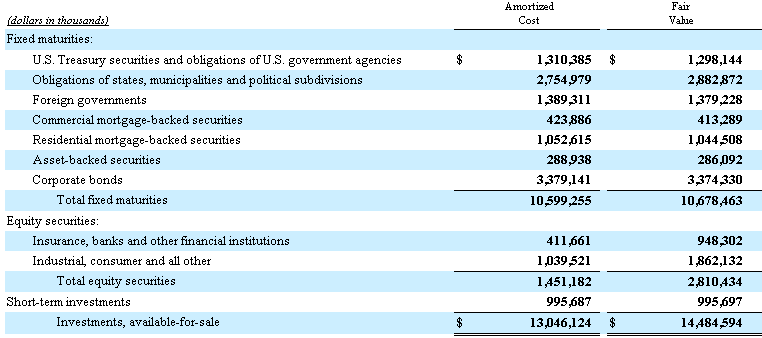

Finally, here is their investment portfolio. I’ve heard this called a ‘mini-Berkshire’ but from the portfolio I have to disagree. That doesn’t mean I don’t like it, but to note they are mainly invested in bonds, as is usual with insurance companies.

This isn’t really the kind of deeply undervalued stock that I look for, so I haven’t bought a position, but it does appear to be a good long term buy and hold.

Disclosure: MKL – no position, AML – long

Hej hej.Jag har en Nikon D510…Jag vill ha ett objektiv som man kan ha när man ska ta kort hemma eller ute men ganska nära sÃ¥ att säga…har du nÃ¥gon bra fundering?