In the last post I went through the 2012 results of a portfolio that follows the buys and sells of my favorite bloggers:

- Alpha Vulture

- Red Corner

- Wexboy

- Moatology (added from 2014 onwards)

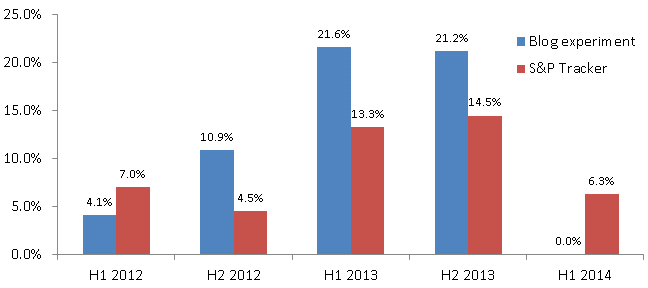

Here are the final results up to 30th June 2014. All portfolio transactions can be viewed in this spreadsheet, and I will aim to update this as time goes by over the next 6 months too.

Cumulative performance: 70.1% for the blog experiment vs 54.2% for the S&P tracker (inclusive of dividends).

H1 2013 performance

The portfolio did well in the first half of 2013 with a return of 21.6% versus 13.3% for the S&P tracker. A few positions were sold, all at a net profit, with the two biggest wins being positions by Red Corner and Value & Opportunity. The number of ideas being generated from the three remaining blogs was about right in this half, when sales of positions were required to fund new purchases there were more obvious candidates than when I included 5 bloggers.

H2 2013 performance

The portfolio did well again in the second half, returning 21.2% versus 14.5% for the S&P tracker. But a number of losing positions were realized during the half in contrast to the 6 months prior. The most notable was selling Supervalu at a 61% loss, followed by Staples sold at a 24% loss. These were both early Barel Karsan positions.

At the end of 2013 the cash in the portfolio was healthy and I decided to add a new blogger to the list watched. Moatology started late in 2013 and I like the stock picks even though most are over the counter so wont be included in this experiment. Nevertheless I want to include it for the few non-OTC positions it does generate.

H1 2014 peformance

You could tell the valuations in the market were getting higher as the frequency of ideas decreased in 2014. Despite this the virtual portfolio was never over 15% cash. Performance however was subdued, returning 0.0% versus 6.3% for the S&P tracker. Most of the sales in this period generated large profits, and the ones that were sold at a loss were small.

Looking over the current portfolio and winnings, performance in general I think has been driven by a smaller number of very big winners and a few more that haven’t really moved a lot. Wexboy alone had 3 picks that all soared well over 100% and he was by no means alone in picking the star performers. Meanwhile the losers have mostly been modest, as you would expect in a value portfolio.

Conclusion

The Blog Experiment portfolio has done well in the last couple of years, returning 70.1% versus 54.2% for the S&P 500 tracker. It definitely seems that following these few bloggers with a very diversified portfolio of around 30 positions can provide out-performance in the short term. In the long term, it is unknown how it will perform, and more importantly, it is unknown how it will perform when the market is in decline.

I think this experiment should have at least convinced you it is worth following these bloggers, I know personally that I have made money from ideas that I first read about on these blogs. Finding good investments is hard, and letting someone else do that hard work for you is highly desirable.

I’m interested to know how this performs over the long term so I will keep it updated and post performance every 6 months. I expect the blogs to change over the years as some become dormant or new blogs appear, but I will keep the list highly selective to keep the number of stock picks at a manageable level. I’m also not including my own picks in this, as I already publish my portfolio and performance in bi-annual reviews.

Very interesting experiment and results. Thanks a lot!

No OTC!? Fair enough, I’ll try to throw a few non-OTC ideas out there.

Very interesting experiment though Andy, it will be exciting to see how it plays out over time. In the meantime, I’ll sleep well at night with MBX as my sole representation in the portfolio.