I was back in my hometown of Sheffield last week and one thing that struck me was how the high street has changed. Rows of empty shops, new small businesses everywhere and lots of pawn shops. It made me think of a post on Expecting Value on H&T Group and so I decided to look at the business myself.

I’m not going into detail as EV already did a good job of writing up the company, but this is the spreadsheet I put together. I like the business model of pawn-broking, and recently purchased a second hand games console from one so know they can offer good value for money even competing with the likes of Ebay and Amazon.

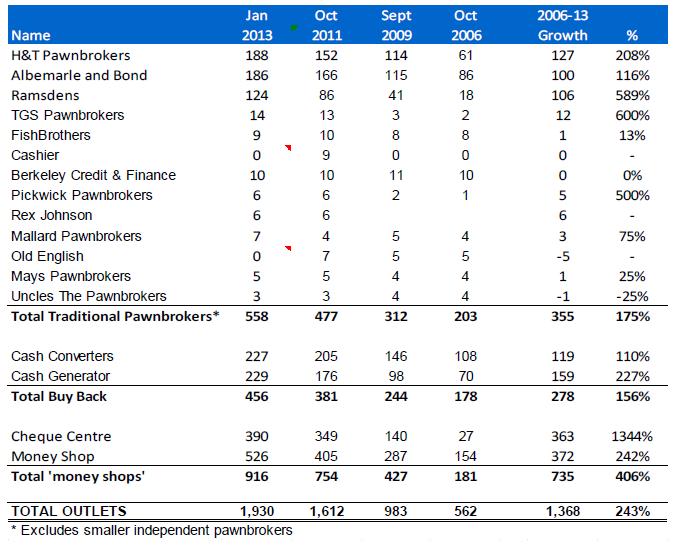

What I don’t like however is the table below showing the number of pawn shops over the last few years, from H&T’s investor presentation.

The industry has been growing for a number of years, irrespective of gold purchasing. There are now almost 4 times the number of pawn shops than there were in 2006. You can see from my table that revenue per store has been declining and is at all time lows (excluding gold buying). I don’t believe this is a short term effect, I think this is the result of the large increase in the number of stores, coupled with a recovering economy.

H&T have given guidance that H2 2013 profits will come in below those of H1 (£3.3m) so we could see net profits of around £5-6m. For a company with an EV of £78m this suddenly doesn’t look so cheap.

I think the industry is heading into a tough time which will lead to store closures and a focus on profitability rather than growth in the post gold purchasing era. That has only just begun and I feel there is more bad news to come so I’ve passed on HAT for now as I don’t think it is deeply undervalued, but it’s on the watch list.

Bearing in mind that it shown quite a boom during the recession and the economy have not really recovered. I reckon that if the economy does recover by considerable margin, the need for these pawn shops may lessened. It seems to me that this is type of business that thrive in bad times.

Cheers,

Joe