Welcome to the latest of my Weekend stock pick’s. This weekends stock is Amlin (LSE:AML), which has been in my portfolio for a while now but I have never written a piece on. Their 2012 results were released last week which makes this a good time to look at the investment case. Amlin has a generous dividend yield of 5.6% and a PE ratio of 8.5. Average return on equity since 2003 is 18%.

The business

Amlin are a leading international insurance Group operating in the Lloyd’s, UK, Continental European and Bermudian markets. They specialise in providing insurance cover to commercial enterprises and reinsurance protection to other insurance companies.

Insurance is all about risk, and this puts off some investors but personally I love investing in this industry. Firstly because you get higher returns for the extra ‘risk’ which should actually be interpreted as wildly variable earnings. Even the best insurance companies will make a loss from time to time, what is important however is to look at their long term level of profitability.

The most important things I look for in insurance companies are good management and strong balance sheets.

The management

There are several quantitative and qualitative characteristics that Amlin has which make it appealing as an investment.

Underwriting is profitable

We evaluate this first by looking at their combined ratio, this is the measure of an insurance companies underwriting profitability. If the ratio is less than 100% then it pays out less than it earns in premiums, hence is profitable.

| Year | Combined Ratio |

|---|---|

| 2008 | 77% |

| 2009 | 73% |

| 2010 | 89% |

| 2011 | 108%* |

| 2012 | 89% |

| Average | 87% |

*2011 was the worst year on record for the insurance industry

These are strong ratios and among the lowest I have seen in the insurance industry. Larger insurers are closer to 98%, and some even operate over 100% (e.g. Aviva) and make up for underwriting losses with investment returns (this is one of the reasons I would not recommend investing in Aviva).

Loss reserves are conservative

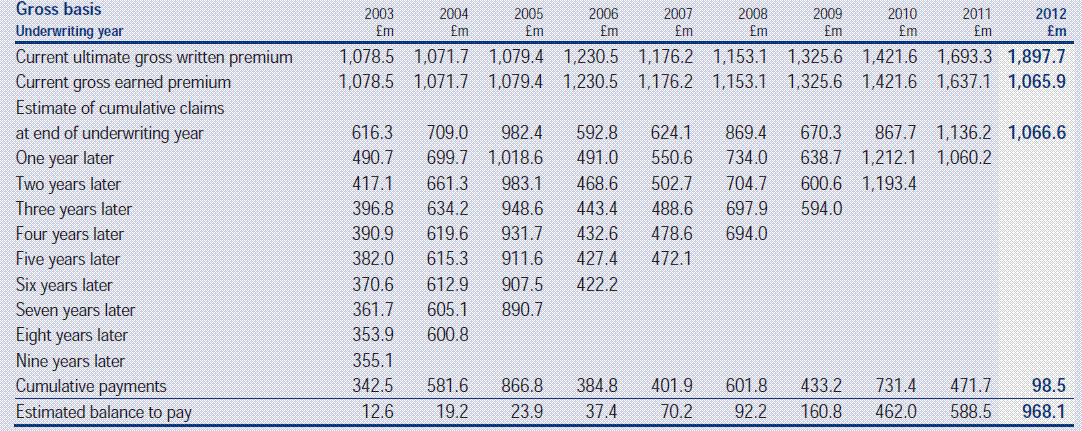

Another indicator of conservatism is the reserves that management allocate. In the footnotes of financial statements insurers will detail their initial reserve estimates of losses in a year, and how these estimates change over time. After 5 years or so the estimates have been backed up by actual claims so are far more accurate.

You can see from the table that the eventual claims are usually lower than their initial reserves. This shows that not only is management conservative in estimating claims, but that the balance sheet could be understating the shareholders equity. Of course this can’t be released without reserves becoming less conservative but gives an additional margin of safety.

Key Performance Indicators (KPI’s)

Return on Equity target of 15% (cross cycle)

Dividend growth

Total shareholder return

“The Group’s commitment to return capital to shareholders has been clearly demonstrated in recent years and we have employed a number of different mechanisms to do so, so as to appeal across the shareholder base. Since 1 January 2008, we have returned £611.5 million to our shareholders. We have also repurchased £27.6million of capital through share buy backs. Importantly, despite extraordinary catastrophe claims in 2011, balance sheet strength allowed the Group to maintain a dividend to shareholders. In the absence of significant catastrophe losses, we intend to increase our dividend per share consistently over the next few years.”

Works in interest of shareholders

Their KPI’s and quote above give a strong indication that management is focused on shareholder return. They demonstrated in 2007 with a special dividend that they are focused on their target of 15% ROE, and will return excess assets on the balance sheet to shareholders. Healthy dividends are also a plus for shareholders.

The balance sheet

Borrowing

The group does have fairly high borrowings of £410m, which increased from £292m in 2011. Solvency is not really a concern with an insurer who by necessity must have large amounts of liquid assets for claims, but I find it interesting that management would rather increase debt than reduce assets in this low interest rate environment. The £292m is an unsecured subordinated debt issue with no financial covenants. The additional borrowing is under a revolving credit facility. The management merely say it was for working capital needs.

Investments

The main asset breakdown is

| Equities | 7% |

| Government Bonds | 17% |

| Pooled Vehicles | 72% |

| Money Market Funds | 27% |

Pooled vehicles are a mix of government & corporate bonds, mortgage backed assets and other investments.

Exposure to government debt:

| Country | £m |

|---|---|

| US | 342 |

| Germany | 300 |

| Canada | 52 |

| Australia | 74 |

| Italy | 50 |

| Spain | 76 |

| Other | 94 |

Three quarters of Spanish and Italian bond exposure is in short term bonds.

Future growth

It continues to expand internationally, having set up a new European underwriter only two years ago. They also see growth in their existing markets due to the strength of their service. They acquired another insurer in 2009 and are still in the process of streamlining the business until it makes an underwriting profit.

Valuation & Conclusion

This is a strong business in my opinion, led by a strong management and in an industry where investors are rewarded for the volatility of returns. I first invested in this business in 2011 after they announced record first half losses from what was a highly unusual year for the insurance industry. At its low point the share price was around 15% over book value which made it a great investment. I personally invested at 32% over book value as it turned out, as the second half of the year again saw record losses for insurers.

Today however the shares trade at a 65% premium to tangible book value but still offer a 5.6% dividend and a PE of 8.5. I consider 2012 to be an average year for Amlin and as such believe this PE is reflective of the cross cycle returns that can be expected.

I think Amlin is currently fairly valued, but it’s a strong business that will grow intrinsic value over time so I won’t be selling any time soon. I bought earlier so have my margin of safety, newer investors will either need to invest in a great business at a fair price or wait until another possible buying opportunity arises.

The insurance industry is one of the riskiest around, returns aren’t guaranteed and the future is uncertain, as 2011 showed (when book value per share fell from 313p to 243p).