This is a short post on Peerless Systems (NASDAQ:PRLS) which I came across on Shadowstock. It is selling for below net cash and management is engaging in one of the most aggressive buybacks I’ve ever seen. Take a look at the table below.

| Quarter | Shares purchased (k) | % of outstanding (diluted) |

| Q2 2012 | 222 | 6.3% |

| Q3 2012 | 50 | 1.5% |

| Q4 2012 | 156 | 4.8% |

| Q1 2013 | 72 | 2.3% |

| Q2 2013 | 269 | 8.9% |

| Q3 2013 | 124 | 4.5% |

Keep in mind these are quarters and you can see just how much it is reducing the share count by.

The company has $11.2m in cash and equivalents, or $4.35 per share, 20% above the current share price of $3.64. What’s more is the company is still generating positive free cash flow, and combined with the buybacks, the intrinsic value per share has been increasing over the last few years. For example at the end of Q3 2012 it had $11.9m in cash and equivalents and this was worth $3.65 per share.

The company itself is pretty boring, it gets revenue from software licenses, a software that is very old and not being developed further so expected to diminish over time. That doesn’t particularly bother me however, considering the company is selling below net cash.

The companies only overheads are essentially its management, the chairman has a base salary of $360k and takes more in the form of stock each year. That is significant considering revenue was only $2.5m in 2013. There was also recently the issue of a lot of common stock for paying the chairman. This current report details the issue of new restricted stock, 250k shares (7% of 3.4m outstanding at the time), only vested if stock price is greater than targets of $3.75-$4.50, or if company de-lists.

The company’s 10-K hints that it is looking around for an acquisition target or new business to enter into. In 2010 the company returned $45m (the majority of its cash) to shareholders and states that it now has more limitations for enhancing shareholder value. Given the company is already small you have to wonder whether the management will cease the share buybacks anytime soon otherwise they wont have much left to invest going forward.

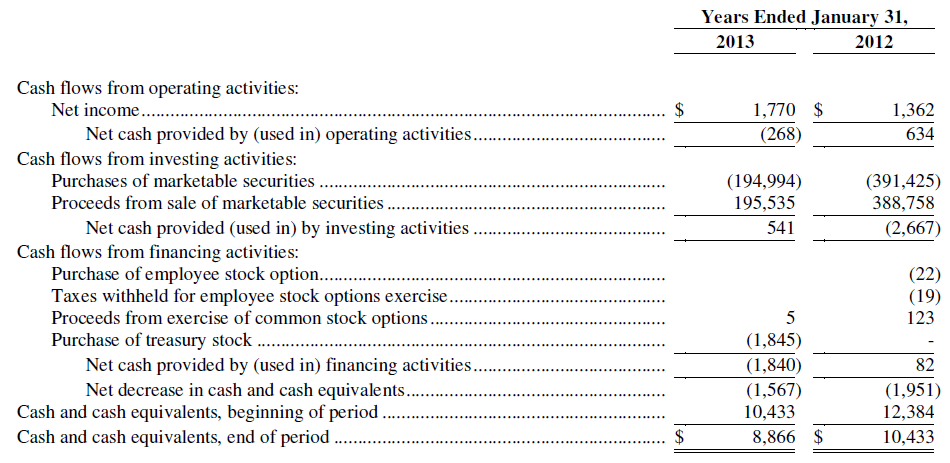

But there is something else very concerning about this company. It wants to get involved in the asset management business, and its chairman fancies himself as some sort of investor. Take a look at the cash flow statement from the last annual report.

Can you spot the abnormality? Income and cash flow is around $1m yet it made $200-400m of purchases and sales of investments during the last couple of years. This definitely to me looks like the company is actively trading with the cash on the balance sheet.

What makes this a red flag is that the company is not authorised to be an investment company. If the SEC requires it to register as one then it will incur significant additional expenses to comply with increased regulation, not to mention any repercussions from trading when not authorised to do so.

I don’t know enough about U.S. legislation to know what risk management’s trading poses to the company, if anyone is reading and does know then I would really appreciate some clarity in the comments. Without knowing this I can’t comment on the downside to this investment, and the upside looks fairly limited even though it trades below net cash.

Disclosure: PRLS – no position

Thank you for the nice write up. I am wondering if you know where the cash come from to purchase securities. I scanned the bs and cf statement and can’t find such large size cash or loan that could finance the securities purchases on the financial statement.Thanks

Hi James

As I understand it, the $11m on the balance sheet is all that is being used, but by being used so many times it adds up to these huge numbers of $200m.

So for example if I buy $10m of AAPL, sell it, then buy $10m of ORCL, then sell it, my cash flow statement will show $20m of purchases and $20m of sales of securities, even though I only had $10m.

Thanks for the answer. That explains it but then he is a speculator.

This is unbridled (and hell, uneducated) speculation, but the abnormality you’ve pointed to looks to me (from an “Occam’s Razor” view) like cash management. Suppose you ran a company and you kept your cash (of value $x) in a series of 1 month jumbo CDs. If you checked your cash flow statement at the end of the year you’d see that you had “purchased” $12x worth of securities and “sold” $12x of the same, and at the end of the year you have (nowadays) $1x. The same logic applies if they have just been rolling 15 day t-bills (that multiple (24X) lines up better with their history, anyway).

I should clarify that you are 100% correct – they do buy & sell stocks and apart from MLNK they are not open about those activities. You would also certainly want to check to see if my speculation is accurate. However if I’m right, you’d be tossing something aside purely because they have slightly anomalous (and potentially innocuous) cash management practices (dead technology business aside for a moment). This could very easily be a simple custody account with their “freezer money” in it set up to automatically sweep to t-bills/inst.CDs and roll them as necessary – or at least if that were the case, a “Cash from Investments” cash flow statement section exactly like this would be the result.

Hi Henry, thanks for the comment.

You are correct, this could all be very innocent cash management, there is no way for us to know for sure unfortunately.

It is interesting that in fiscal 2013 the purchases were $200m, and the year before double at $400m. I would have thought if they were just rolling t-bills you’d get pretty consistent figures each year.

Yet on the other hand the management doesn’t strike me as the type to trade in and out of equities with such a high frequency so I’m torn.

Agree, the only way to know is to ask their IR person. The figures are definitely odd, and there doesn’t seem to be a discernible pattern to them either (first 3 quarters of 2012 were ~28, ~165, and ~1). I’d just say that unless the CEO has completely lost his shit he’s not turning over $9m 17x in 90 days.