Northern Bear is a small company in the UK providing “specialist building services”. Segments include Roofing activities, which provides a range of roofing services, including slating, tiling for domestic, commercial and public sector properties; Materials handling activities, which includes supply, service and maintenance of fork lift trucks and warehouse equipment, and Building services activities, which provides things like fire protection and asbestos removal.

It has a market cap of £9.5m and trades on London’s AIM with a trailing P/E ratio of 5.9. My initial thought was that it was in some kind of trouble, or had warned on profits, but that isn’t the case. It simply seems to be a case of the market overlooking a small cap to me.

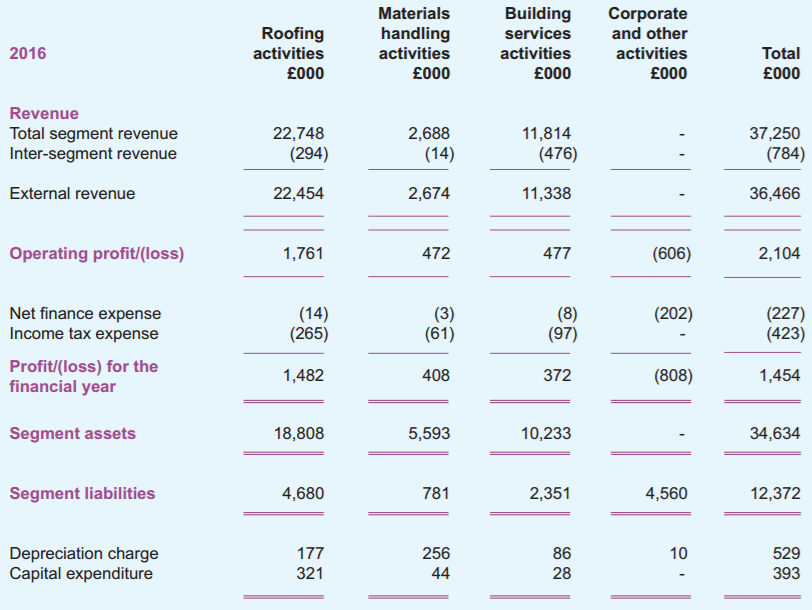

Here are the results of the various segments in 2016.

The company is fairly similar, and linked to the state of the housing market in the north of England. It also has some exposure to government spending through work it does on public sector buildings. Some positives that I like about the company:

- Free cash flow has been very strong in the last 6 years and shows that earnings are a fair reflection of the cash that the business is generating.

- Two years ago it started paying a dividend and yields 3.7%. This is covered 4.5x by cash flow.

- Net debt is low at £2.3m compared to profits of £1.6m.

- Over the last 6 years, EPS bottomed out at 2.7p in 2013 during a bad year. It bounced back to 7.5p the next year. These are still favourable compared to the current share price of 53p.

- The last few years have been spent paying down debt, but now management seems happy with the level of debt and that cash will go into other things now, like acquisitions or directly to shareholders as higher dividends.

- The executive chairman owns 7% of the company, and Jon Pither (co-founder) owns 14% but has no seat on the board as he has a stake in another company named Southern Bear and wanted to avoid conflicts of interest.

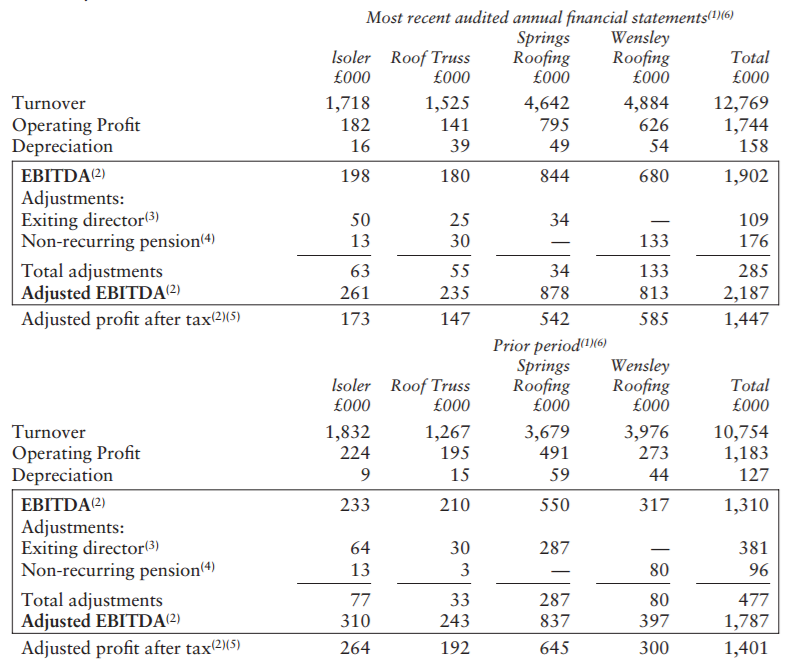

The company doesn’t have a complete history of annual reports on its website, so I can’t see how it did during the recession, but here are the earliest financials I can get, from their admission document to AIM in 2006.

It claims a profit after tax of £1.4m on £12m in revenue. That compares with a profit TTM to 2017 of £1.6m on £38m in revenue.

The company has clearly grown, but reduced in profit margins. This isn’t altogether surprising given the state of the housing market in the UK now compared to 2006. Whilst it is currently going through a good period, it isn’t reaching the silly heights of pre-financial crisis from what I have seen in the north of the UK.

Some things I don’t like about the company:

- It is difficult to assess how the company performed during the recession, but it claims in the 2016 Annual Report that it has reported a profit in every year since its admission to AIM.

- The stock has traded at a low P/E for the last 6 years, so it’s unlikely to get re-rated unless it starts to grow substantially (which I don’t think it will do unless it starts acquiring businesses). If profits dip, historically the share price has tanked along with it, but has created better buying opportunities as a result.

- Return on equity isn’t exciting at 7.3%. Considering the company does make acquisitions, this could suggest they don’t great value from them.

- Current ratio is a little low at 0.9, so there is a risk that they run into short term difficulty and have cash problems.

Despite all these, I think it’s an attractive stock, and have bought a position. I’ve put 4.3% of my portfolio in it.

Disclosure: Author is long NTBR

You can get older copies of their accounts for free from Companies House:

https://beta.companieshouse.gov.uk/company/05780581/filing-history

03/2008: PAT of £1.6m on revenue of £32.2m

03/2009: PAT of £2.2m on revenue of £41.8m

03:2010: LAT of -£1.4m on revenue of £35.0m (the loss becomes a profit of £0.8m once exceptionals of £2.2m are added back)

Commentary from the 2009 accounts: “…another year of earnings growth despite the current unprecedented economic conditions…continues to be very cash generative…These results clearly demonstrate the robust nature and sound defensive qualities of our diversified business model”.

Great to know thanks. I didn’t know that beta site went so far back like that.