Another 6 months have flown by and it’s time to report on my portfolio’s performance again. At the end of the first half of 2017 I was in the midst of investing in a large pot of Japanese small stocks and haven’t made many changes to the portfolio since. I had 26% cash but this quickly reduced to 13%, so I was almost fully invested for this half.

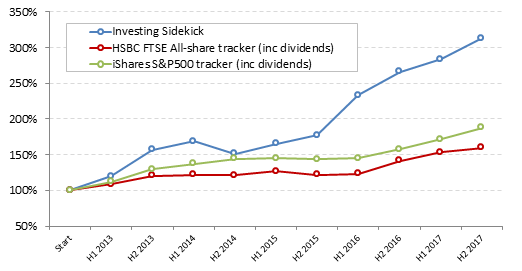

The portfolio returned 10.4% in H2 2017, outperforming the FTSE All share tracker which returned 4.4%, and the S&P tracker which returned 9.8%. That brings my cumulative performance since inception in 2013 to 313%, or 26% annualised.

I keep thinking these years of good performance need to end at some point as the stock market cools off but the end isn’t in sight yet. I generally think my portfolio is somewhat uncorrelated to the wider market, given that most of my money is concentrated in relatively few UK small caps, and 25% is now in a basket of Japanese small caps.

Winners & Losers

Below are my holdings ranked by return to the overall portfolio in the half year.

The biggest contributor was the basket of Japanese stocks which returned around 20%, but I still think this is one of my best prospects going forward and is worth at least double what I paid for it. Ubiquiti Networks had a strong year and the share price is up 154% on my purchase price. I’m continuing to hold, as even at a P/E ratio of 23, given its stellar growth I think it is still at a fair valuation and am a long term holder. I will only consider selling if the valuation becomes unrealistic.

Goldplat and Northern Bear also did well, and I would also say they are still attractive investments.

Current Portfolio

My portfolio is given live on the site, but here it is with position sizes.

| Oracle | ORCL:US | 2.2% |

| Apple | AAPL:US | 2.4% |

| Ubiquiti Networks | UBNT:US | 6.3% |

| Goldplat | GDP:LN | 8.5% |

| Renn | RUG:LN | 0.9% |

| Gattaca (formerly Matchtech) | GATC:LN | 1.5% |

| Weiss Korea Opportunity | WKOF:LN | 7.7% |

| United Carpets | UCG:LN | 1.9% |

| Cambria Automobiles | CAMB:LN | 2.4% |

| IG Group | IGG:LN | 4.9% |

| Just Eat | JE/:LN | 2.9% |

| Revolution Bars | RBG:LN | 2.7% |

| Northern Bear | NTBR:LN | 4.9% |

| Pental Ltd | PTL:AU | 2.7% |

| Codan Ltd | CDA:AU | 3.2% |

| Fujii Sangyo | 9906:JP | 2.1% |

| Fujita | 1770:JP | 2.2% |

| Sapporo Clinical | 9776:JP | 3.1% |

| Nansin | 7399:JP | 1.6% |

| Youji | 2152:JP | 1.0% |

| Togami Electric | 6643:JP | 2.9% |

| Kawaden | 6648:JP | 1.6% |

| Yamada | 6392:JP | 3.7% |

| Broadcasting System | 9408:JP | 1.7% |

| Heian Ceremony | 2344:JP | 1.2% |

| Muro Corp | 7264:JP | 1.2% |

| TOSNET | 4754:JP | 2.0% |

| Will Co | 3241:JP | 2.1% |

| DOM security | DOMS:FP | 2.9% |

| Softbank | SFT:GR | 1.7% |

| Awilco Drilling | AWDR:NO | 0.4% |

| Cash | 13.5% |

I also have two long bets on GBPUSD and GBPJPY to hedge my foreign currency exposure. Given all the macro events going on with the UK at the moment, I have no idea what the currencies will do so I wish to remain as immune as possible.

In the year ahead I’m hoping to deploy most of my cash. I have a long watch list that needs further research and I’m confident there are some gems in there. There are some worries in the small cap market with Brexit looming and hopefully it will continue to present opportunities. For the most part though, the wider market doesn’t seem too worried.

Hi,

Nice work.

two questions:

1. I see you hold IGG. Did you look at PLUS500? very low PE, regulated, grew this year nicely. I’m an Israeli so maybe I have a “home bias”.

2.About opportunities in UK small cap – did you check SUS? market cap doesn’t move much but earnings keep rising.

Hi

1. I’ve looked at it before, but I think the fact it’s Israeli put me off as for me it’s a big unknown. I don’t know anything about the country or its laws, so don’t know what protection I have from unscrupulous management. Also the business itself isn’t one I like. I own IG as they’re a big operator and I’m confident they are acting responsibly, but I know plenty in this industry aren’t and are enticing people into trading/gambling that shouldn’t be. I fear that’s the kind of thing regulators will eventually stamp out.

2. I looked at SUS not long ago as it happens. I discarded it fairly quickly though when I looked at its cash flow, and that it can’t seem to generate any from its operations. There may be some quirks to the accounting with a finance company, but to me it signals their profits are suspect.

Happy New Year!

I had a look at Pental Ltd. The Balance sheet is very solid, the stock Looks cheap. But in their current trading update they mentioned disruption in the Australian retail landscape as a reason for lewer results. I guess the disruption is called ALDI.

Do you think your Investment case is still valid?

Thank you for a short feedback.

BR

Sutje

Happy New Year!

Yes Pental is going through a rough patch. I’m not too pessimistic about it as it seems to me that they’re going through what happened in the UK a while ago, and most of the big brands are still around.

I feel like the investment case is still ok as it has proven to be quite defensive, but saying that I don’t see where growth is going to come from so I’m looking at it now and thinking it’s quite fairly valued rather than undervalued. It’s a good job I had a margin of safety.

This is probably among the least favourite of my holdings and would be one of the first to go if I needed the cash for something else. The only thing keeping me really is the dividend which is a healthy 6.5% yield.

Hi,

Thanks for the feedback.

I agree.

Only by cutting costs they will not get back their margins.

They have to be successfull in new markets (Exports to Asia), new customer groups (Commercial) or new products to be a bargain at the current price.

Cheers

Sutje