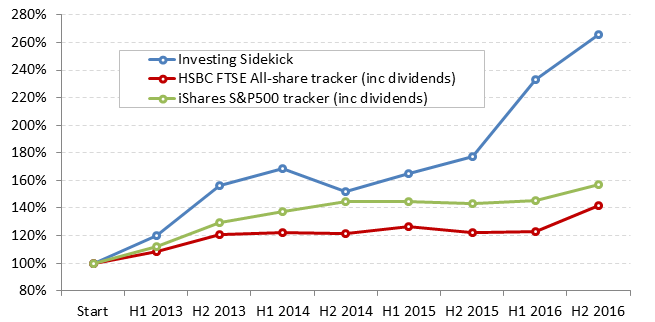

In the second half of 2016, I spent very little time on my portfolio. It’s one of the benefits of having a value strategy buying good companies, that you can mostly forget about them. At the start of the half, I was 49% in cash, so I expected to underperform the market by quite a margin. I was pleasantly surprised that my portfolio was up 13.9% in the half, versus 15.1% for the FTSE all share tracker and 8.3% for the S&P tracker. Not bad considering.

The devaluing pound helped some of my positions a lot. I had 28% in foreign holdings at the start, of which 11% was USD which was hedged.

Here are the most significant contributors to my 13.9% gain, sorted by their % affect on my portfolio.

| Bloomberg Ticker | ||

| Beximco Pharma | BXP:LN | +3.2% |

| Ubiquiti Networks | UBNT:US | +2.7% |

| Codan Ltd | CDA:AU | +1.6% |

| 800 Super Holdings | ESH:SP | +0.8% |

| Russia 3x tracker | RUSL:US | +0.7% |

| Argo | ARGO:LN | +0.6% |

| Apple | AAPL:US | +0.5% |

| Weiss Korea Opportunity | WKOF:LN | +0.4% |

| Softbank | SFT:GR | +0.4% |

| Saga Furs | SAGCV:FH | +0.3% |

I have already sold Beximco Pharma, and both UBNT and CDA are still short of my fair value estimates. The only negative contributor was Goldplat (GDP:LN) which is still short of my fair value though I haven’t added to the position.

Texhong Textiles ($2678:HK)

I sold this position during the half, but don’t think I reported it. Including dividends and FX movements, it returned 146%, or 53% on an annualised basis. In pure share price terms, it was up 90% on my purchase price. I sold because I thought it had reached about fair value, and I don’t have a great grasp on the business itself to hold long term. Shares are down 6% since I sold.

Gattaca (GATC:LN)

This company was formerly known as Matchtech. This was a new position entered in the half that I didn’t write up. It is a human capital resources business dealing with contract and permanent recruitment in the private and public sectors. It has a strong history of revenue growth (though it acquires) and has recently faltered. There are lots of worries about Brexit as well. It’s at a forward P/E of 7.

This was my portfolio at the end of the year. My up to date portfolio is, as always, on the Portfolio page.

| Ticker | Size | |

| Cash | 41.5% | |

| Weiss Korea Opportunity | WKOF:LN | 7.1% |

| Goldplat | GDP:LN | 6.7% |

| Beximco Pharma | BXP:LN | 6.6% |

| Ubiquiti Networks | UBNT:US | 6.6% |

| Pental Ltd | PTL:AU | 3.8% |

| Codan Ltd | CDA:AU | 3.3% |

| DOM security | DOMS:FP | 2.8% |

| United Carpets | UCG:LN | 2.7% |

| 800 Super Holdings | ESH:SP | 2.6% |

| Oracle | ORCL:US | 2.4% |

| Apple | AAPL:US | 2.1% |

| Argo | ARGO:LN | 1.9% |

| Gattaca (formerly Matchtech) | GATC:LN | 1.7% |

| Logicamms | LCM:AU | 1.7% |

| Softbank | SFT:GR | 1.7% |

| Russia 3x tracker | RUSL:US | 1.4% |

| Renn | RUG:LN | 1.0% |

| Saga Furs | SAGCV:FH | 1.0% |

| Awilco Drilling | AWDR:NO | 0.6% |

| Hornbeck Offshore | HOS:US | 0.5% |

| Avanagrdco | AVGR:LI | 0.3% |

In 2017, my main priority will be to put my large cash position to good use, and hope that more Brexit effects come up, like the triggering of article 50, that create some bargain opportunities.

Hi what is the thesis on CODAN?

My original thesis is here

http://investingsidekick.com/codan-limited-cda-ax/

It was a recovery play from a particularly bad year. Right now, the share price is up 170% from where I bought it, so I wouldn’t say it’s a great buy. My target price is about $2.70