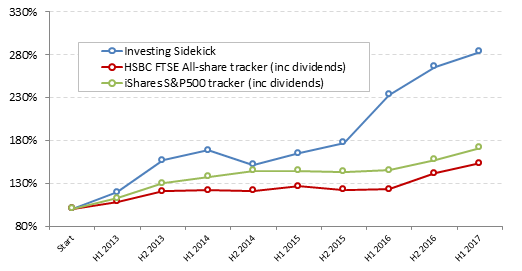

I’m a little late in getting around to posting this, but here’s my usual half year summary. I started 2017 with 41% in cash, so expected my performance to lag the rest of the market unless I put that cash to good use or unless the market went down. As it happened, the market was up and my expectation was correct. My portfolio returned 6.7% while the FTSE All share tracker returned 8.2% and S&P tracker 8.9%, all including dividends. I’m fairly satisfied with that, and even more satisfied that by the end of June I had put a lot of that cash to good use. My cash position is now 11% and my current portfolio is below.

Winners

My biggest winners of the half were Goldplat (GDP:LN) and Weiss Korea Opportunity (WKOF:LN). The former produced strong operating results and was up 28%, giving good gains as it was a 7% position. I still think the company is cheap, and stands to profit from any economic shocks that cause the price of gold to soar, so is a nice hedge. WKOF was up 25% but that was mainly due to fx gains. The underlying Korean shares are still trading at a huge discount to true value.

Losers

Logicamms (LCM:ASX) was down 49% and I sold the position to realise the loss. My initial thesis on the company turned out to be wrong, and the company coming cap in hand to investors for cash should have been the point at which I sold. In the end I delayed and it cost me further. I don’t think the long term prospects of this company are clear at all, and I’m not bullish on commodities in general, so I’m out.

Ubiquiti Networks (UBNT) was down 15% which contributed to lower performance given its a larger 5% position. I’m not too bothered by this. In H2 2016 the price soared by 52% so this is just a small correction. The fundamentals of the company are still good, and it is up 87% on my purchase price today. This is a long term holding for me though, as I like management and I like the company. The price would have to double for me to consider selling.

New positions

The main use of cash in the half was buying a basket of cheap Japanese shares. I focused on small profitable companies with good cash generation, some signs that the company valued shareholders like dividends and share buybacks, and of course, share prices below intrinsic value. I was surprised just how many companies there are. The one issue is my inability to read Japanese, hence I relied on third parties for financials, and bought a basket of 13 companies to protect me somewhat from the lack of due dilligence. Altogether, 25% of my portfolio is now in this basket.

My current portfolio is below, with position sizes. The holdings I am most bullish about are Cambria Automobiles, Northern Bear, and the basket of Japanese shares.

| Name | Bloomberg Ticker | Size |

| Oracle | ORCL:US | 2.7% |

| Apple | AAPL:US | 2.4% |

| Avanagrdco | AVGR:LI | 0.2% |

| Ubiquiti Networks | UBNT:US | 5.2% |

| Goldplat | GDP:LN | 7.2% |

| Argo | ARGO:LN | 1.6% |

| Renn | RUG:LN | 1.0% |

| Gattaca (formerly Matchtech) | GATC:LN | 1.7% |

| Weiss Korea Opportunity | WKOF:LN | 8.0% |

| United Carpets | UCG:LN | 2.4% |

| Cambria Automobiles | CAMB:LN | 2.7% |

| IG Group | IGG:LN | 4.7% |

| Just Eat | JE:LN | 2.9% |

| Northern Bear | NTBR:LN | 6.3% |

| Pental Ltd | PTL:AU | 3.8% |

| Codan Ltd | CDA:AU | 3.7% |

| Fujii Sangyo | 9906:JP | 1.9% |

| Fujita | 1770:JP | 1.8% |

| Sapporo Clinical | 9776:JP | 1.6% |

| Nansin | 7399:JP | 1.7% |

| Youji | 2152:JP | 0.8% |

| Togami Electric | 6643:JP | 3.3% |

| Kawaden | 6648:JP | 1.5% |

| Yamada | 6392:JP | 2.7% |

| Broadcasting System | 9408:JP | 1.6% |

| Heian Ceremony | 2344:JP | 1.3% |

| Muro Corp | 7264:JP | 1.2% |

| TOSNET | 4754:JP | 2.2% |

| Will Co | 3241:JP | 2.2% |

| DOM security | DOMS:FP | 3.3% |

| Softbank | SFT:GR | 1.9% |

| 800 Super Holdings | ESH:SP | 3.2% |

| Awilco Drilling | AWDR:NO | 0.4% |

| Cash | 10.9% |

Disclosure: Author is long all discussed companies bar LCM

Solid performance! I am really enjoying reading your blog.

I’m curious if your thesis on Softbank has changed since you invested.

Especially considering their huge bet on tech through the Vision Fund.

Howard Marks certainly has his doubts…

https://www.cnbc.com/2017/07/27/oaktree-marks-questions-softbank-fund.html

Thanks.

I think the Softbank thesis has changed and I’m not too impressed with their latest investments. As it was simply a way to invest in Alibaba and that’s getting increasingly diluted I think I’ll be re-assessing it. It’s not a large position for me so I’ve been leaving it be for now.