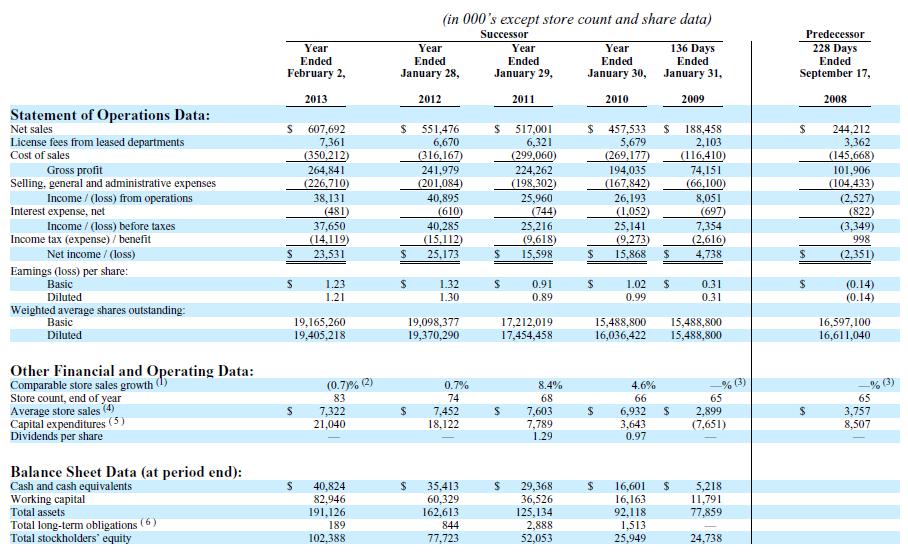

Gordmans stores (NASDAQ:GMAN) is trading near 52 week lows and on a PE ratio of just 9.4. It earns an impressive 15% return on assets and is growing revenues by 10% a year. Is this company a good long term investment?

Sagicor Financial (LSE:SFI) is currently trading at a large discount to book value and yields a great 6.9% dividend. It has a price earnings multiple of only 3.5 on continuing operations. So what’s the catch

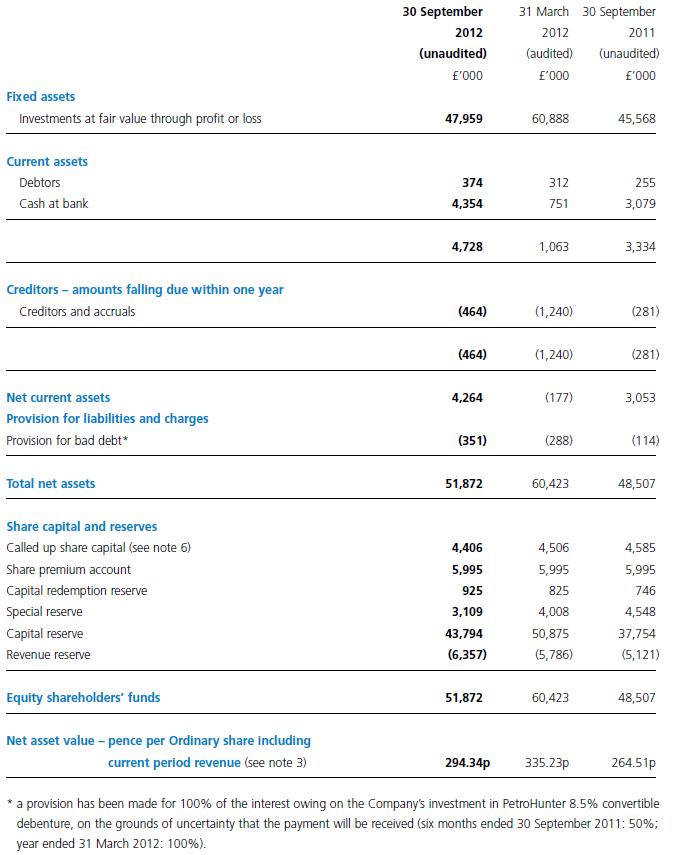

Renaissance Investment Trust is selling at a 28% discount to book value, and expects to wind down by 2015. It will start returning cash to shareholders by early 2014. This is investment offers a great margin of safety and some upside potential.

After Tesco's latest results were released this week, I had to write about them as the value of the company has changed in my opinion.

It's been a long time since I've read about a stock that's got me excited, but a good hedge fund selling at a discount to book value has done the trick. But all is not as great as at first glance.

The next installment of my Weekend Stock Picks looks at the insurer Amlin, a stock I have held for the last couple of years and which has a good dividend yield and is one of the strongest insurers in the industry.

Aker Philadelphia Shipyard (AKPS.OL) Aker Philadelphia Shipyard is a leading U.S. commercial shipyard constructing vessels for operation in the Jones…

I’ve decided to start a new series every Friday, entitled Weekend stock pick. The idea is that I will post…

Some news on one of my holdings, Outdoor Channel (NASDAQ:OUTD). This was an investment in a special situation where a…

Ambassadors Group is an interesting company I’ve come across as an example of a competitive advantage and intangible barriers to…