One of my most successful investments over the last couple of years was in Kentz, which was a typical Buffett buy and hold forever type stock. Kentz operates in the oil and gas industry, offering engineering and construction services with high returns on capital. I bought it at a time when the oil & gas industry wasn’t doing too well and it was around a P/E of 13, but Kentz went from strength to strength and netted me a 134% gain in just over a year. If they hadn’t been taken over I would still hold them.

But moving onto Bouvet, this is a Norwegian IT consultant and bears some similarities to Kentz.

- It earns impressive returns on invested capital – 64% in 2013.

- Cash generation is strong, over the last 5 years free cash flow has equaled 106% of net income.

- Strong growth – EPS compound growth rate is 13% p.a. over the last 5 years and 15% over the last 8 years.

- Weakness/cost-cutting in the Oil & Gas industry is affecting the business.

- The business is selling at a P/E of 12 and is in a net cash position.

- Most of free cash is paid out as dividends, giving it a high dividend yield of 7.3%

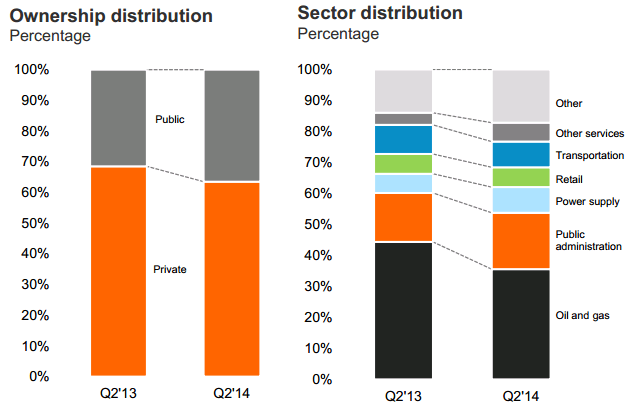

Although oil & gas is its largest revenue source, it also comes from a mix of public and private companies spread across different sectors. Almost all this revenue however is in Norway. It has attempted to spread to Sweden but has found competition to be harsher.

Business mostly comes from prior customers in this industry, in the latest quarter 91% of revenues were from repeat business. Companies tend to stick with IT consultants that they have used in the past and trust.

Bouvet Financials

A look at the headline EPS figures over the last few years shows that growth hasn’t always been smooth for Bouvet, it has seen EPS fall in 2 of the last 9 years.

The financials speak for themselves and the investment case seems pretty obvious – strong growth at a good price and high cash flows. But stocks like this aren’t cheap for no reason, and I won’t downplay the difficulties now facing the business. Despite EPS falling in the past, this has been mostly due to operational issues rather than revenue declines. This time it’s different. Revenue fell 2.8% year on year in Q2 2014, the largest fall they have seen outside the recession of 2009. Earnings per share was more heavily hit, down 16%.

A fall in revenue in one quarter isn’t in itself worrying, however this is compounded by a new warning management has given in its outlook summary in the investor presentation.

“Cost cut within Oil and Gas

Continued strong focus on digitalization in all sectors

Increased competition will challenge profitability

Strong adaptability opens for further growth and improved profitability in the long term”

In all the prior periods of earnings decline it has never issued a negative outlook like this, so investors should take note of this sudden change of tack.

Conclusion

Bouvet is currently trading at NOK 81, with NOK 9.5 in cash per share and TTM EPS of NOK 6.70. For a company growing earnings at 13% per annum this is cheap. But short term headwinds in the Oil & Gas sector are going to affect profitability, and have already led to a 16% decline in first half EPS.

In situations like this I have learnt that patience is rewarded; when faced with earnings reductions, intrinsic value can rapidly vanish and it’s better to wait until the business shows some stability in its earnings before investing. Also the cash level of my portfolio is very low, so I’m reluctant to enter new positions unless very compelling. For now Bouvet gets added to my watchlist and I’ll be reading future results with interest.