Welcome back to the AIM IT Project, where I am going through and valuing all the investment companies listed on the Alternative Investment Market (AIM) of the London Stock Exchange. This spreadsheet lists the companies covered so far and performance since.

Legendary Investments (AIM:LEG)

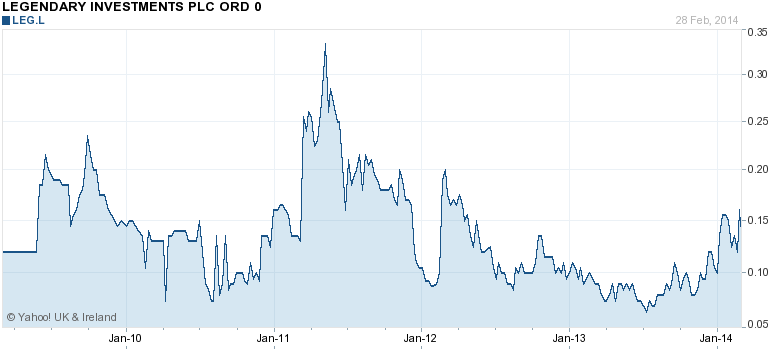

With a name like ‘Legendary’ you might have expected better performance. It may not look as bad as some of the other companies I’ve covered listed on AIM, but I’ve spared you the horrific chart going back to 2000 – I suspect this company started off investing in some dotcom companies given the enormous decline in share price it suffered early in its life.

For a company with net assets of £388k and annual admin expenses of circa £190k, it is at first baffling why this company has a market cap of £2.38m. Perhaps there is some hidden gem on the balance sheet that canny investors have spotted?

Its strategy is to “deliver high returns through proactive investment in growth companies” and has a mixture of both listed and unlisted investments. I will cover only the unlisted investments as the listed ones will be marked to market on the balance sheet.

VirtualStock – on balance sheet for £50k, only invested in October 2012 so probably not worth a huge amount more. It provides a cloud based stock management solution and has won business from major UK retailers such as Tesco.

Bosques Energeticos – agriculture company held for tens of £k, with land worth several million pounds apparently, LEG’s stake would be worth over a £million. Has exciting yield of crops that mature twice as fast as usual due to GM.

Manas Minerals – In July 2012 invested £100k into this coal development company that is still surveying land.

If public message boards are anything to go by, then the VirtualStock and BE holdings are the reason for the apparent high valuation. But like with most unlisted investments they are incredibly hard to do due diligence on. I’ll be generous and take management at its word that their stake in BE is worth ~£1m, and given new contract wins from VirtualStock lets say the stake has doubled in value to £100k. That means the company actually has net assets of £1.44m and a valuation slightly below that given annual expenses of £190k, still far below its current market cap.

Bear in mind this stock also has significant dilution every year, although so far that has been at share prices above the current price so not value destructive.

Share price: 0.14p

NAV per share: 0.024p

Valuation: 0.079p

Upside: (44%)

India Capital Growth (AIM:IGC)

IGC invests primarily in listed Indian companies, and is bigger than most companies that I’ve covered so far, with net assets of £38.3m. The fund has performed poorly since its launch in 2005, still trading below the original issue price and is only rated 1 star. For a fund that invests in listed equities this pretty much summarises its investment performance too. Unsurprising then that this fund trades at a 23% discount to net assets.

The company tried to raise more capital through a share subscription in December 2013, allowing existing holders to purchase 1 share for every 2 held, but the attempt failed as investors weren’t interested. Interestingly the company is having a vote in 2015 on winding up according to this article, maybe one to watch in the future if its still trading at a big discount and the wind up gets voted through. For now I think the discount is warranted given the funds poor performance and I don’t have any particular opinion on what the Indian Stock Market will do in the future, it doesn’t seem in a distressed state to me.

Share price: 34.75p

NAV per share: 45.46p

Valuation: 34.75p

Upside: 0%

Weiss Korea Opportunity (AIM:WOKF)

This is a fairly new company, listed in May 2013, and invests primarily in listed preferred shares of South Korean companies which are trading at discounts compared to the common shares. Sounds like an interesting proposition then with a margin of safety (finally a good strategy, it only took 5 posts!), particularly if one is bullish on South Korea, or its currency the Won, which is unhedged. It trades at a 7% premium to Net Asset Value and has a market cap of £123m.

The investment manager is Weiss AM, a Boston based manager with £700m AUM, who claims to be a deep value investor looking for undervalued securities. Its flagship fund is the Brookdale Global Opportunity Fund, this article shows how it has bought and wound up undervalued closed ended funds in the US as an example of its activities.

Something in the monthly factsheet caught my eye, the weighted average trailing P/E ratio of its holdings is 5.8, and preferred stock is apparently 49% undervalued when compared to common. Samsung, its biggest holding, has common stock on a P/E of just 6.6. On average, South Korean equities are at 16.8x earnings apparently.

I had a look into why Weiss believes preferred shares are trading at a discount to common stock. Usually preferred shares are entitled to a coupon, and are not entitled to a share of profits (unless convertible). However looking at Samsung preferred for example, this does not appear to always be the case. In its results it gives a line “net income available for preferred stock” and “basic earnings per preferred share”. On page 26 of the 2012 Annual Report, it shows that earnings per common and preferred share are almost the same, so in theory the common and preferred should trade at about the same price, minus a small discount because the preferred are non-voting. But Samsung’s common are currently priced 27% higher than the preferred. The Value & Opportunity blog actually already covered the discount that Hyundai preferred are trading at (see the end of the article) and shows historically there wasn’t a discount, and I believe has an arb position in it.

Before I considered a position, I wanted to also take a closer look at the South Korean stock market and see if it is a bad place to invest at the moment. As it turns out, its stock market, KOSPI, hasn’t really done much since 2011.

The index seems to have held up well in the emerging market sell off, but a strengthening Won has worried investors that the countries exports will fall which has led to recent market weakness.

The index seems to have held up well in the emerging market sell off, but a strengthening Won has worried investors that the countries exports will fall which has led to recent market weakness.

I don’t like to invest based on macro conditions, but South Korea has a lot going for it; it isn’t plagued by government debt problems like the rest of the world, it has low debt and runs a budget surplus. So there don’t appear to any big red flags with the area beyond the usual political risks with emerging markets.

In all I like this fund, and despite it selling at a premium I like the companies it is invested in (or rather I like the current valuations!) and think that the discount of preferred to common gives this investment the margin of safety I always seek. In my valuation I am going to mark up the holdings to account for the discount the preferreds trade at. The last report said the weighted average discount was 49%, i.e. the NAV if it were in common stock would actually be double. I will only increase NAV by 90% as preferred should trade at a small discount.

Share price: 117.5p

NAV per share: 110.11p

Valuation: 209.2p

Upside: 78%

I intend to initiate a position in WOKF as I like the manager and it has stated shareholders will be offered to be bought out in 2018 at NAV, hopefully differences between preferred and common stock have narrowed by then. But all my free cash is in a tax free account (ISA) with a broker that doesn’t trade AIM. I don’t want to lose the tax free status so will have to wait until April 6th when I can open a new ISA with another broker and transfer cash. That’s a long way of saying I will be buying but probably in late April/May.

Disclosure: LEG, IGC – no position, WOKF – no position but intend to initiate one.

It’s interesting that you bring up Weiss Korea Opportunity, since I just read this a little while ago:

http://ify.valuewalk.com/wp-content/uploads/2014/02/moi201401_ideas-korea.pdf

I think that might add some more color to your post about that fund. I agree that it looks like an interesting opportunity.

Thanks for the link, I hadn’t seen that article.

Very useful to see the historic discounts of preferreds, I’m surprised its always as large as 30%, maybe I was a bit aggressive in marking up. The one example I’d seen, Hyundai, showed that they didn’t really trade at much discount historically.

Hopefully this opportunity still exists when I have the cash to pursue it.

Another interesting piece on Korean preferreds

http://www.scribd.com/doc/123485753/Investment-Case-for-Hyundai-Mobis-Preferreds