Welcome back to the AIM IT Project. You can find the list of AIM listed Investment companies here which is updated regularly. All the companies I have covered so far can be found in the spreadsheet here.

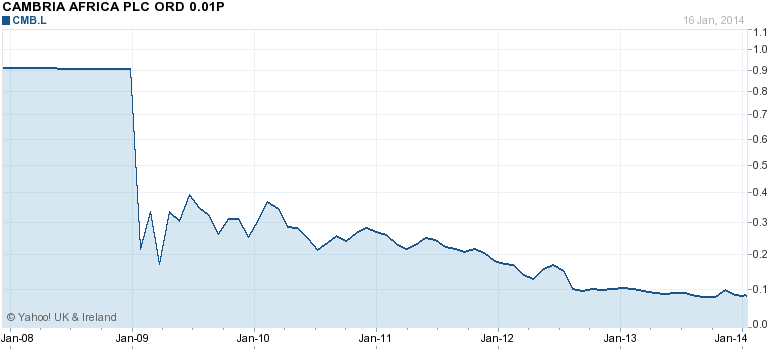

Cambria Africa (AIM:CMB)

The chart above doesn’t need too much explaining for it to be clear that CMB has been a disastrous investment for shareholders over the last 6 years. It invests in companies in Zimbabwe and like many small AIM Investment Trusts it holds a few concentrated positions in companies that it exercises control over.

The company was originally called LonZim but in 2012 the board was overhauled and the company name changed to Cambria Africa. The company wrote off a signficant number of ‘goodwill’ assets from the balance sheet and book value is now 94% backed up by net tangible assets.

CMB also has another common feature of small AIM companies, it posts significant losses every year which forces it to continually issue new shares in order to stay solvent. This has been to the detriment of existing shareholders.

In the companies latest interim report the new board has shown significant progress in turning around the companies it owns and making them ultimately profitable. However half yearly operating losses were still ($1.8m) on $6.5m of revenue which to me is nowhere near break even. And compared to the market cap of £5.5m means that future share issues to cover these losses will likely significantly impact on shareholder value.

Hence, in terms of valuation, I think a discount to the NAV is warranted. If the company could stem the losses and stabilise the declines in tangible book value then it may be worth what it can be liquidated for. At the current rate, expenses are causing the NAV to decline by around 12% a year. If it took 3 years to reach break even that would reduce NAV by 39%. But on top of this would also be the dilutative share issues, reducing NAV per share although not as easy to quantify. I think the current market cap is probably fair given the risks.

Market Cap: £5.5m ($9.1m)

Net Asset Value: $23.6m

Valuation: $9.1m

Upside: 0%

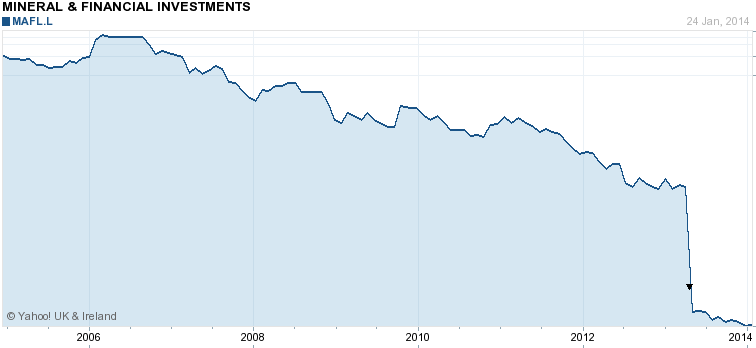

Mineral & Financial Investments (AIM:MAFL)

Not surprising to see another ugly chart here. In the first update I read on this company I read something that immediately put me off too

“…[we] increased exposure to gold…”

But the next line definitely caught my attention given the current share price of 5p

“Total cash at period end: £797,000 [was] 5.8p per share”

First a bit of info on the company itself. What a surprise, it was formerly known under another name, Athol Gold (I’m starting to see a pattern here) and then changed to Athol Gold and Value. 6 months later it was called Mineral and Financial. There was no change of control here however, the chairwoman has remained the same throughout, I guess they got bored of the losses on gold mining stocks to decided to switch strategy.

They are now investing in larger more liquid stocks, which is useful to me for valuation purposes. But a significant investment is a £600k loan to Silvermere Energy, which turned sour recently when the company couldn’t repay. Another company rescued it but intends to make it a software investment company and MAFL now has equity in this.

This company has a tiny market cap and the boards fees (£35k+ p.a.) and other operating expenses (£100-220k), are onerous and a huge drag on performance. Although the company’s portfolio is in listed stocks I think a big discount is warranted. I don’t really have a strong opinion on the current value, so I’ll say the market cap, being 50% of NAV, is probably a fair value.

Market Cap: £0.6m

Net Asset Value: £1.1m

Valuation: £0.6m

Upside: 0%

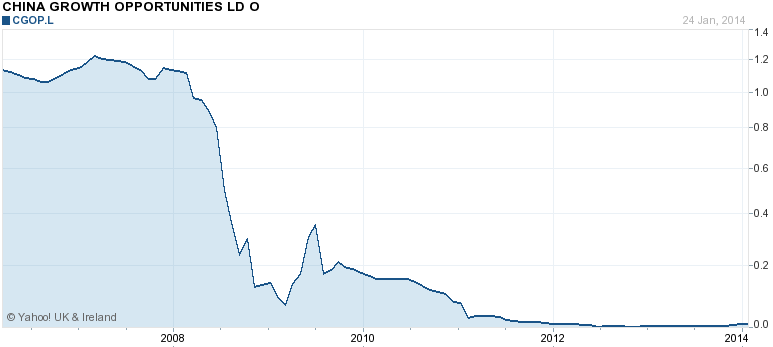

China Growth Opportunities (AIM:CGOP)

Another horrific graph, nothing unusual for these small Investment Trusts as you have probably gathered by now. But what you may find unusual is that this company trades at 11x its net asset value. It’s even more shocking when you consider this company has Net Assets of only £77k and the costs of being a listed company are well over £100k per year.

The company is undergoing a restructuring and will…wait for it…change its name. The only reason I can see for this wild valuation is that the company is looking to raise new capital and grow the fund. Shareholders obviously expect new shares to be issued at an enormous premium to the current NAV. The latest share issue I have found raised capital at 1p per share (current share price is 1.25p).

A browse of popular message boards in the UK shows no rumours or special goings on. There is nothing in the news either so I can only conclude that this is pure speculation. This company is only worth its AIM listing, which are not worthless and often investors will come in and takeover a failing company, but I can’t put a reliable value on it.

So this company as it stands is worthless, buthaving said that, if it does issue new shares at 1p then obviously it will be worth closer to 1p a share. I can’t value it relying on this however.

Market Cap: £880k

Net Asset Value: £77k

Valuation: £0

Upside: (100%)