Craven House Capital presents an almost unbelievable special situation. Selling at only 64% of its net assets, it is issuing new shares for almost 5 times the current share price, benefiting shareholders.

Sino Grandness grew profits by 100% last year, a long running trend, yet trades at a P/E ratio of just 6.7. There is of course a catch, but in my opinion the upside here far outweighs the downside. This is a chance to buy a wonderful company at a bargain price.

With stock markets reaching all time highs it is natural for investors to feel a bit uneasy about putting more money into shares. Special Opportunities Fund (NYSE:SPE) is a closed ended fund which can protect investors from a downturn whilst still having upside, unlike cash.

Kentz is a specialist construction company for the oil and gas industry. It earns returns on equity of 25%, has net cash equal to a quarter of their market cap ($181m) and trades at a PE ratio of 9, the lowest it has been since 2009. This is a fantastic long term investment with a large margin of safety at today’s prices.

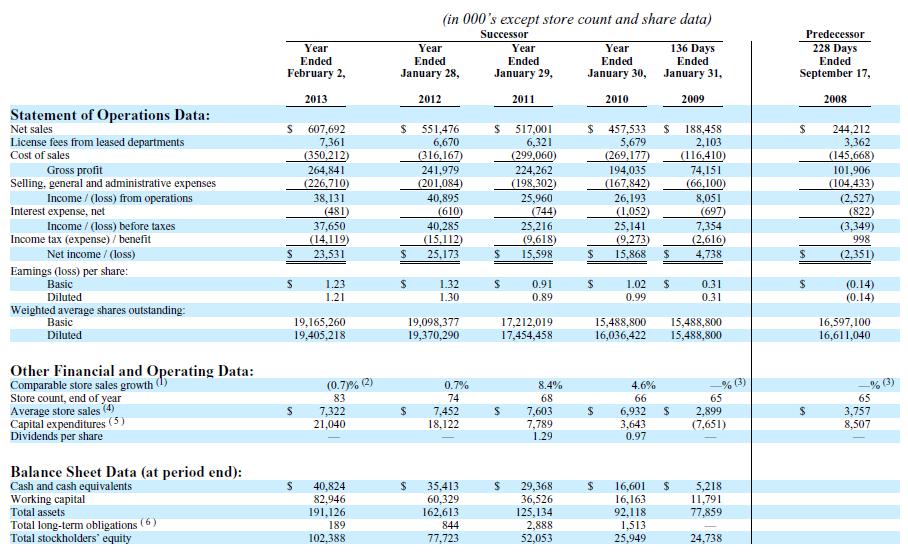

Gordmans stores (NASDAQ:GMAN) is trading near 52 week lows and on a PE ratio of just 9.4. It earns an impressive 15% return on assets and is growing revenues by 10% a year. Is this company a good long term investment?

Sagicor Financial (LSE:SFI) is currently trading at a large discount to book value and yields a great 6.9% dividend. It has a price earnings multiple of only 3.5 on continuing operations. So what’s the catch

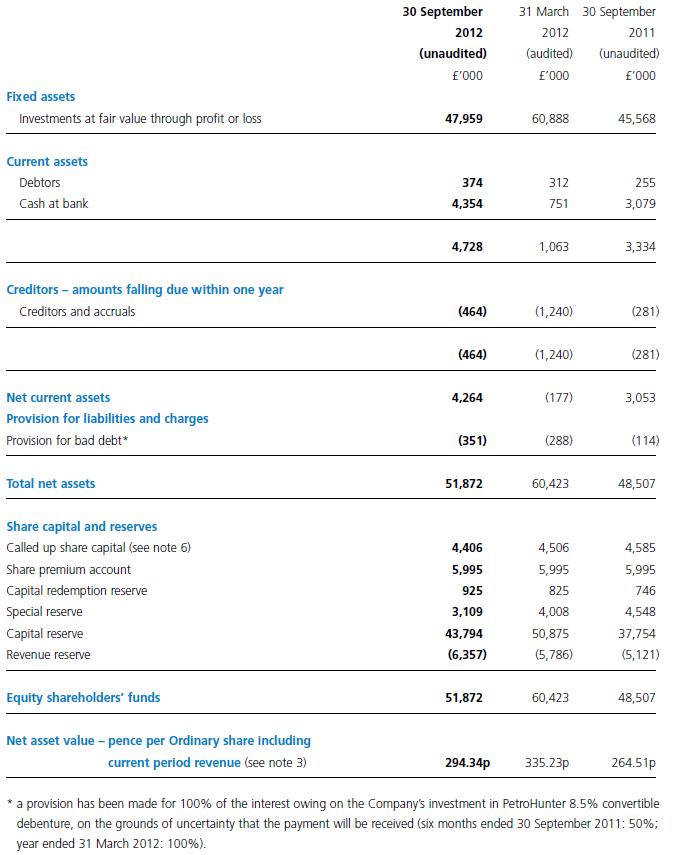

Renaissance Investment Trust is selling at a 28% discount to book value, and expects to wind down by 2015. It will start returning cash to shareholders by early 2014. This is investment offers a great margin of safety and some upside potential.

After Tesco's latest results were released this week, I had to write about them as the value of the company has changed in my opinion.

The next installment of my Weekend Stock Picks looks at the insurer Amlin, a stock I have held for the last couple of years and which has a good dividend yield and is one of the strongest insurers in the industry.

I’ve decided to start a new series every Friday, entitled Weekend stock pick. The idea is that I will post…