John Paulson gave an interview on CNBC in which he described the “best investment for a retail investor”. To some it may come as a surprise that this wasn’t some stock or bond, it was to buy a home (or primary residence).

For many this will represent a large investment, possibly larger than the whole of their equity investments put together. So why is John Paulson saying it is a good idea?

- Housing is an essential cost, if you don’t buy a house then the alternative is renting. Paying a mortgage lasts a finite time, renting lasts forever so in the long term (30+ years), buying is almost always cheaper.

- High leverage means outsized returns. If I put down a $10k deposit on a $100k house, and that house goes up to $110k in value, I have a return of 100% on my initial outlay.

- Interest rates are low – it has never been cheaper to borrow money.

I want to focus on the second point above, because ‘high leverage’ to any value investor brings one thing to mind – high risk. If that house instead falls to $90k in value, you have just lost $10k. If it falls to $80k in value you are now trapped in negative equity. Over a period of 20-30 years the chances of house prices being below where you bought are minimal due to inflation, but in the short term it can create financial pressure on you, especially if interest rates rise in combination (and house prices are correlated inversely to interest rates which makes this scenario realistic).

But more than that, us value investors can’t stand paying more for an asset than it’s worth. Even though we are long term focused and pretty much guaranteed to be better off buying in almost any scenario, we can’t help but want $1 for 50 cents and practically vomit at the idea of paying $2 for it.

So we can’t help but be curious, what is the intrinsic value and how do you assess your risk? There are always pundits saying house prices will crash, or interest rates will rocket. How do you know what a ‘fair’ value of a house is. In this article I’ll look at how you can assess this. I don’t disagree with John Paulson, buying a home is a great investment – but from an academic point of view valuing a house is very interesting.

Where to begin valuing a house?

Most people will be familiar with the huge industry in house valuation and selling. Agents use similar sold prices in the area to see what the market is willing to pay for a house and will advise you on it. But us value investors know better than to trust Mr Market to value our assets. If the market fails in such a highly competitive and liquid market like the Stock Exchange, then do we really believe it works for real estate when:

- Real estate is highly illiquid with few transactions locally

- A lot of buyers and sellers have little investment knowledge, and could be thought of as simply ‘dumb money’

So where do we start? Well there is another market connected to real estate that is more liquid and more competitive. It also involves more sophisticated investors. This is the rental market.

Using the rental market

Most big cities will have a large rental market with apartments and houses competing with one another for tenants. This market is much more liquid – people can move around far more freely and will do so if their rent is beyond other rents near by.

Because of this liquidity, the rental market is more competitive and much better reflects supply and demand of housing in the area. If more people want to rent than there are houses available then landlords will charge higher rents. Conversely if few people want to live in an area landlords will have to compete harder on pricing to attract tenants.

Finding market rents is also relatively easy, simply browse a local agents website to find a list of advertised apartments and the rents requested.

But how do we use these rents to determine the value of a house?

Well we treat it as the same as any other investment, its value is the discounted sum of all future cash flows. But there is no need to put together a complex equation, all this says is that the ‘intrinsic value’ of a house is proportional to the rental income it achieves.

Rental yields

To calculate, Rental Yield = Annual Rent / House Price. If we assume that Annual Rent in the current market is fair, and we know a normal rental yield is then we can calculate intrinsic value as Annual Rent / Normal Rental Yield.

But what is a normal rental yield? Well this is the tricky part, there is no universal answer. For me living in London, the norm is for rental yields to be low because of the high demand for houses in the capital and void periods (when houses sit empty waiting for new tenants) are very short. If I was to live in a small town in central USA, a normal rental yield would be much higher. We need to review the historical rental yields in a specific area, and this isn’t easy. Data is scarce and can be difficult to locate.

Example: London

I am going to look at London as an example because house prices have risen around 50% in the last year in some areas. Many are calling it a bubble, others say it’s simply high demand from an increasing population. It’s also easy to get data on London. Here is a table with the current rental yields on London property in different areas.

| Postcode | 1 Bedroom | 2 Bedrooms | 3 Bedrooms | |

| EC1 | City of London | 4.5% | 3.0% | 4.6% |

| W1 | Central London | 2.9% | 2.7% | 2.5% |

| W8 | Kensington | 2.7% | 2.3% | 3.5% |

| W9 | Maida Vale | 4.4% | 3.7% | 3.1% |

| W11 | Notting Hill | 3.3% | 2.8% | |

| W12 | Shepherd’s Bush | 3.9% | 3.3% | |

| W14 | West Kensington | 3.5% | 2.9% | 2.4% |

| NW1 | Camden | 3.9% | 3.5% | 4.3% |

| SW8 | South Lambeth | 3.2% | 4.2% | |

| SW10 | West Brompton | 3.4% | 2.5% | 3.1% |

| SW11 | Battersea | 5.6% | 4.5% | 4.2% |

| SW12 | Balham | 4.8% | 4.1% | |

| SW15 | Putney | 5.7% | 4.4% | 3.7% |

| SW17 | Tooting | 4.5% | 3.8% | 4.5% |

| SW18 | Wandsworth | 4.8% | 4.1% | 2.9% |

| SW19 | Wimbledon | 4.7% | 3.8% | 3.4% |

| N1 | Islington | 4.5% | 4.1% | 3.8% |

| E14 | Poplar | 5.8% | 5.5% | 4.9% |

| E15 | Stratford | 6.4% | 6.1% | 5.4% |

| SE10 | Greenwich | 5.4% | 4.4% |

Source: http://www.londonpropertywatch.co.uk/average_rental_yield.html

You can see how much they vary within even one area, depending on the size. Also some areas, like Central London, which has high cash-rich foreign investment, have far lower rental yields than less affluent areas in London like Putney:

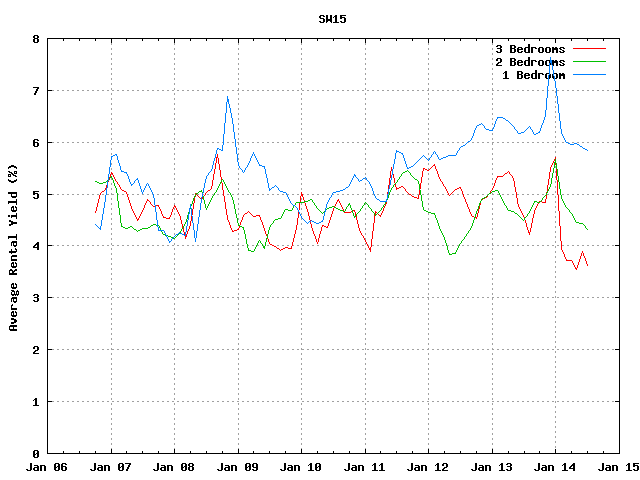

The chart shows historical rental yields in Putney, though only for the last 10 years or so. These may look fairly flat to you, but don’t be deceived by the power of rental yield. For example a rise in yield from 4% to 6% may not seem like much, but at constant rental income represents a 33% fall in house value. This chart suggests a 1 bed flat in Putney may represent good value at the moment.

The chart shows historical rental yields in Putney, though only for the last 10 years or so. These may look fairly flat to you, but don’t be deceived by the power of rental yield. For example a rise in yield from 4% to 6% may not seem like much, but at constant rental income represents a 33% fall in house value. This chart suggests a 1 bed flat in Putney may represent good value at the moment.

We don’t just need to look at history though, also think from the perspective of a landlord. What % return would you want from a particular house? It would depend on things like what interest the bank pays you. If it’s high at 5% you wouldn’t invest in a property yielding 4% in rent. Conversely, while it’s low now at sub 2% suddenly even a rental yield of 3% looks attractive.

Let’s take a look at Central London:

This shows a completely different and interesting picture. I would be wary of buying a property in Central London at the moment with rental yields so low. If a more normal 5% yield returns, house prices could halve in value. At the very least this suggests that house price inflation cannot continue at the rate it has been without becoming dangerously overvalued.

Conclusion

This analysis can be a good guide when purchasing a house but like I said early in the article, buying a home is almost always cheaper than renting in the long term. Even though rental yields in an area can be abnormally low, you don’t know how long they will remain so. For every year you wait, that is an extra year of paying rent. Unless you foresee some catalyst on the horizon for house price falls, then the sensible thing to do is buy a home that you can afford to make payments on (under higher interest rate scenarios too!)

Also, there is more to buying a home than from an investment standpoint. Having your own home where you can raise a family in stability has a lot of intangible value. On the whole I agree with John Paulson, buying a home is probably the best investment someone can make.

Interesting post and surely a current topic in many parts of the world!

Putting aside intangible value (which can become a burden as well, selling a house can become very difficult unless you’re ready to get rid of it at a significantly lower price. Considering the human aversion to loss, this has proven for many people to be quite a psychological challenge when leaving aside the tangible side o it), I would hesitate buying Mr. Paulson’s argument.

What are the cost differences of renting vs. buying (let’s keep to apartments as houses are quite rarely rented as far as I know). If you rent, your cost is the monthly rent you pay. If you own, your cost is the monthly interest on your loan + repairing expenses (at least in Finland, tenants in general pay only if something breaks/is damaged because of them/their actions). Depending on the situation these costs can tip the weigh on either side (if you take a 30 year fixed interest rate loan, the increases in rent will quite likely become larger than the interest after sometime).

What I didn’t see mentioned, was the fact that one can invest the same money that was used in buying the apartment somewhere else when renting instead of buying. If you have a 10% down payment on the apartment, you could use this to invest in stocks for example. Every year this investable amount increases (depending on the cost differences discussed above) more or less the amount of principal payments on the loan. If the stock market returns beat the increases in apartment prices, this creates an extra return when renting.

I don’t necessarily mean to say that renting is better than buying, in some situations buying for sure is better. But especially with the property prices seen in many places today, I would be careful in saying that buying a home is the best investment one could make. Please do say if you see some big gaps in my thinking, but I think it’s not fair to leave out the opportunity cost.

Kind regards,

60°North

Very fair points, and I didn’t really go into detail about renting vs buying on a monthly basis. I’ve worked up spreadsheets myself to try and compare costs etc but always come back to the same thing – after 30 years where will I be? With a house/flat I’ll own an asset that has appreciated in value a lot and I’ll have low monthly costs on maintenance. Renting I will be paying considerably more in rent as it rises with inflation.

It depends a lot on where you live but here in the UK most houses are built of brick and stone. These will tend to last a long time and rarely need any work structurally.

Also the opportunity cost of the deposit is a good point, but if you work out the returns needed to beat a leveraged investment in housing if it ticks along with inflation, they need to be pretty high. Of course this can work against you as well!

Good comments in reply to both Milud and myself. Want to point out though that ownership still comes with many costs that tenants don’t pay (interesting to hear if they do somewhere!), for example all the big home appliances like fridge, dishwasher (and washing machine in some cases) need replacement/repairs at times. When talking about apartments, there are things that need more or less expensive maintenance/repairing after some tens of years (sure, if you buy new and discount, these may not be that much), for example plumbing, windows, electricity etc.

One additional point worth making. If we think about buying vs. renting from the perspective of diversification and the risk that comes with it, you should really at least have the potential to make considerably more when buying. Up to debate, but I feel like if we’re comparing buying vs renting home from an investing perspective, it’s reasonable to say that it could be compared to putting all your money in one company vs. diversify? Without the potential to have bigger returns one wouldn’t obviously go with one company. With apartments, you could actually do it so that you rent your apartment and then with the money you’d buy your home, you buy one (and by time second, third when with your home you’d pay down the debt) and rent it out. Surely this way at first you’re similarly putting all eggs in one basket, but diversifying by time.

Kind regards,

60°North

Andy,

Thanks for your article.

Surely a house may render inestimable values, especially if raising a family there.

If you do not spend anything on the house the next 30 years until you pay off the mortgage it will probably deteriorate very much and you can only hope that the land keeps it’s value – e.g. a new flight route over your house reduces demand for it. Progress may render even a well maintained house less desirable.

Usually a home owner spends per year more on a house than what he paid as rent. A tenant can invest this difference in a low cost index fund. He will diversify, whereas the typical owner puts much of his wealth in only one investment.

You described the fluctuation in home prices. What if your job, a divorce etc. forces you to sell the house in a down market?

A house may turn out as one of the best investments in your life, even not considering the emotional benefits. But it is not a sure thing.

Milud

Well land value, aside from freak events like an airfield being built, usually goes up here in the UK. Its one of the best inflation hedges.

I’m interested where you live where rent is only as much as maintenance on a house! Here in London rent is only slightly below the monthly repayments on a mortgage (but with record low rates). Beyond a lick of paint apartments/houses don’t need much spent on them here.

I guess in the US you have a lot of homes made of wooden construction, which are probably far more expensive to maintain in the long term than stone. Housing is one of those things that varies greatly for each local area I guess.

Andy,

For simplicity I assumed you pay as much for the mortgage as you do pay for rent at the moment you buy a house – rent equals mortgage. To make it even easier for the home buyer he takes a 100% mortgage – so no opportunity costs on the down payment. Still the buyer incurs costs either now or at a sale (real estate agent, legal, taxes). After 30 years the buyer owns a house 30 years old if newly built or one 30 years older than when bought, the mortgage is being paid off.

From an investment point of view the house and any invested money from saved rents need a greater value than what your investments are worth from saved costs minus more rental costs in later years when you have reduced the mortgage and rental costs have risen.

There may exist houses for which like old-timers or master paintings people will pay more. Normally assets after production are on their way to the scrapyard in their individual time; therefore exist accounting items like depreciation and capital expenditure. Robert Shiller showed that real (inflation-corrected) home prices in the USA did not increase much from 1890 (100) to 2011 (116).

I wonder if one would want to live in a house newly built 1984 without any maintenance or improvement.

With a house one can buy and keep all these items for which space lacked in an apartment – soon the double garage is full with clutter, cars on the road, and a tent is erected in the garden to store more of this stuff.

It does not need a new airfield next to you, changing the flight routes to an existing one is enough. What if your neighborhood deteriorates, or only the house next to you is bought by some lunatics who start feuds? Your job is transferred to another country just after you bought your house; the real estate market and the economy at your home crash; either move and sell at a huge loss or be unemployed? When your family breaks up and you can no longer afford the house you must sell even if home prices are less than what you paid.

The fate of your house investment will depend on which house you buy and what price you pay for it – like investments in stocks. No automatism for success with your house. Most people are not wealthy enough to diversify sufficiently by buying 10 or more houses in different locations or states.

Persons who know real estate well will succeed with their buying. Others will profit from a market rise in their location – luck. Others will lose money if you take into account opportunity costs; these may still be happy because of emotional gains or because they were forced to save via the mortgage.

In Germany, where I was born, most people regard real estate as the only investment, perhaps together with time deposits; stock investing is for them gambling. That appears too simplistic to me.

I do not know what incentives John Paulson has to advertise home buying.

I think Paulson’s comments might reflect the unique American situation. In the US, most people can get 30 year fixed rate mortgages at, as he mentions in the interview, ~4.5%. Essentially, because of government support, housing is the only plausible “investment” in the US for which you can get 30 year financing. Moreover, you can get it at significantly below what a “market” rate would be without government intervention.

Given how most fixed rate mortgages in England have only 2~10 year terms*, I’m not sure if Paulson’s advice works there. After all, Paulson’s seems to be a strong believer in higher future inflation, given his large gold holdings. If significant inflation does happen, a leveraged bet on an inflation-safe asset like housing financed with fixed rate debt would probably be a better investment than stocks, never mind bonds. However, if you take away the extremely long term fixed rate debt financing, you suddenly lose the major advantage of Paulson’s idea. After all, if your interest payments reprice to match inflation, you’re not much better off than if you’re renting.

Also, I’m not sure if I understand what you mean by:

“…buying a home is almost always cheaper than renting in the long term. Even though rental yields in an area can be abnormally low, you don’t know how long they will remain so. For every year you wait, that is an extra year of paying rent.”

Wouldn’t you want rental yields to stay low forever, assuming you didn’t have to buy a house eventually? The lower the rental yield, the less you can pay to get the benefit of having a home, relative to the value** of the home. Why wouldn’t you want to take advantage of cheap rents as long as you can?

Put another way, imagine an airline that currently leases its planes for 4% of the planes’ value annually. What you’re proposing is that the airline should sell bonds at a higher interest rate (say, 6%) to buy the planes outright. Why would that make sense?

After all, you wouldn’t say that “…buying a plane is almost always cheaper than leasing in the long term. Even though leasing yields for a certain plane can be abnormally low, you don’t know how long they will remain so. For every year you wait, that is an extra year of paying lease fees.” You would merely be happy that leasing fees are low.

In short, I think Paulson’s advice is particularly targeted towards the US, where you can get extremely cheap, extremely long term financing for an inflation-resistant asset in an environment where every other asset is fully or over-valued and high inflation is a serious possibility. If you take out any of those characteristics, his advice no longer applies. This is especially true if you lose the cheap, long term financing, which is something you don’t have in England.

* This is correct, right? I did look into this a little bit, but being American, I’m unsurprisingly not intimately aware of how mortgages work in England.

** “Value” here being the price of the home, which obviously isn’t the same as its true intrinsic value, but we’re going to say they’re equivalent for this paragraph to make descriptions easier.

Incidentally, my airline example doesn’t take into account the way that landlords usually cover maintenance for rental properties. Essentially, what you seem to be recommending is that the airline replace its cheap leases with higher interest rate debt AND assume all maintenance cap-ex previously paid for by the leasing company.

It is worth noting that I assumed based on the rental yields you have in that table that English mortgage rates are higher than those yields. Another look at English mortgage rates seems to indicate that that might not necessarily be true.

Regardless, my point is that buying is better than renting only if rental yields are significantly higher than mortgage rates. Those yields have to be higher to the extent that what you save on rent and gain in leveraged price appreciation covers the opportunity cost of putting down a large down payment, not to mention the various intangible issues (illiquidity, etc.).