Sino Grandness grew profits by 100% last year, a long running trend, yet trades at a P/E ratio of just 6.7. There is of course a catch, but in my opinion the upside here far outweighs the downside. This is a chance to buy a wonderful company at a bargain price.

Outdoor Channel has now gone private and I made over 12% in just a couple of months. This was a great example of an investment with protected downside.

With stock markets reaching all time highs it is natural for investors to feel a bit uneasy about putting more money into shares. Special Opportunities Fund (NYSE:SPE) is a closed ended fund which can protect investors from a downturn whilst still having upside, unlike cash.

A quick scan of the markets nowadays shows that many banks are selling for below their net tangible assets. For a value investor such as me, this is usually a great sign that an investment is undervalued. If a company has net assets above its market value then it can simply liquidate and return cash to shareholders, giving an instant return. However banks are different.

A couple of years ago I read up on Halfords business and was on the fence about whether to invest. I decided to pass in the end and a recent news release has made me reflect on the thoughts I had at the time. Many of those are still relevant to Halfords today.

Cranswick announces growth in revenues and profits with a strong outlook for the future. But with the shares at a PE ratio of 14, are they now fully valued and should I sell them from my portfolio?

Kentz is a specialist construction company for the oil and gas industry. It earns returns on equity of 25%, has net cash equal to a quarter of their market cap ($181m) and trades at a PE ratio of 9, the lowest it has been since 2009. This is a fantastic long term investment with a large margin of safety at today’s prices.

What is a good investment to make in a recession? Most companies do badly but there are some that flourish in difficult economic times. EZ Corp is one of those businesses that has done well, but how will it do if the economy improves?

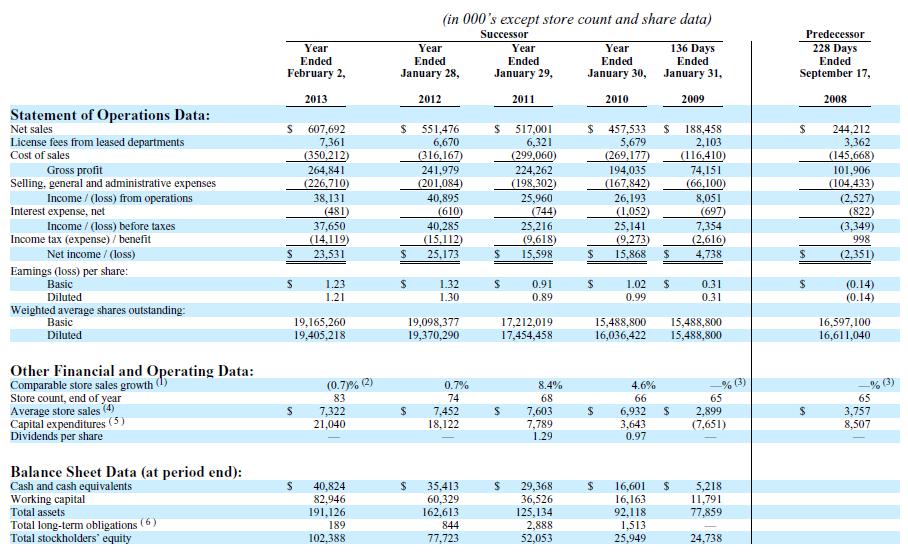

Gordmans stores (NASDAQ:GMAN) is trading near 52 week lows and on a PE ratio of just 9.4. It earns an impressive 15% return on assets and is growing revenues by 10% a year. Is this company a good long term investment?

The new website has now gone live and the subscription service is fully functioning. Anyone that has subscribed by email should have received a notification to re-confirm their subscription.