Firstly a quick apology to followers of the blog, you may have noticed a distinct lack of posts over the last few months. I have fallen victim to a chronic illness which I am still struggling to manage. I’ve done a little reading here and there into companies during this time to keep myself entertained but haven’t been able to do any thorough searches for undervalued stocks. So my posts from now on will be continue to be quite sporadic and quite brief, just summarizing the investments I’m making and my reasoning, rather than anything too in depth.

So onto Logicamms, which is a business I have had on my watchlist for a while. It is a company that provides consulting and engineering services to the mining, construction and oil & gas sectors in Australia. As you may expect, the market is very pessimistic about its prospects given the collapse in oil prices and the bear market now apparent in commodities. When I first looked at Logicamms I didn’t feel I could properly judge the level of profitability it could sustain going forward, but now there is a further year of accounts to peruse and also management have guided on 2016 performance. In short it expects to make $4m in the first half of the year, and claims its pipeline of work is stronger for H2 2016 than it was for H2 2015. Full year EBITDA will be in the range of $9-12m, which means it is trading at a forward EV/EBITDA of just 3-3.7.

Guidance was given in the chairmans address at the AGM, and other figures can be got from the 2015 Annual Report.

Good points

- Company has forecasted excess cash of over $10m at the end of the year, giving it an enterprise value of $36m. Even if it makes no profit in H2 at all, its P/E is only 9 at this low point in the earnings cycle.

- Actual cash it currently has is higher at over $20m however it clearly plans to utilitse some of this

- Good dividend payer, with dividend yield of 10.6% (though next years dividend likely to be lower), and it is well covered by earnings

- Strong cash flow generation; long term, net profits seem a good proxy for free cash flow

- 80% of revenues derived from ‘brownfield’ projects rather than ‘greenfield’ projects, so not as reliant on exploration spending

- Personnel expenses account for a large % of the company’s total expenses. The company will have more control over these and hence more control over its profitability due to high gross margins

- Strong balance sheet, current ratio is over 2 and has positive tangible equity

- Returns on equity strong, should still be in the range 5-10% even if 2016 turns out to be a poor year as expected

- Asset light business, not much cap ex required

- Has been buying back shares while the share price is low

- Company has been profitable as far back as reports go, to 2007

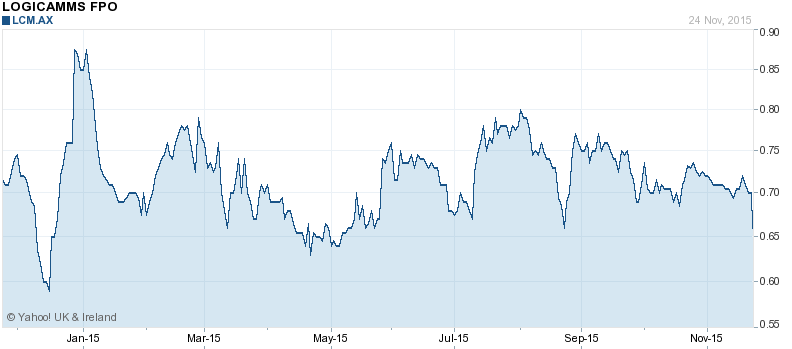

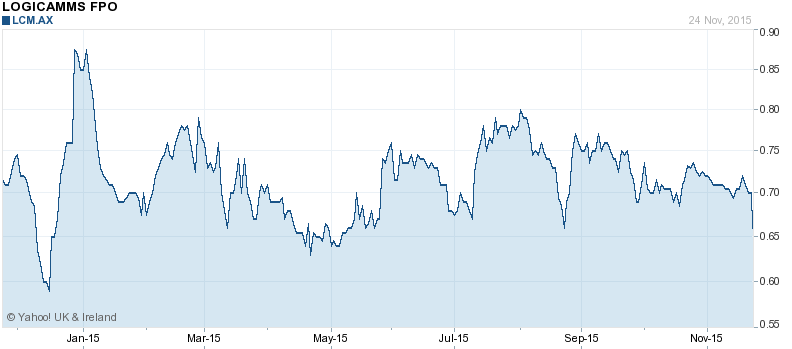

- [Warning: technical analysis incoming!] The share price seems to have a ‘support’ around the current share price of $0.65

Bad points

- 65% of revenue is from Oil & Gas companies, which will come under further pressure next year

- The full effects of the declining oil price haven’t really fully hit I feel. Capital expenditure is planned to be further restricted next year by oil & gas companies, so LCM could end up warning on profits if the oil price declines continue.

- Directors only have token share holdings, likely all from options given to them

- Management keen on acquisitions, not really clear how much value they are getting from them

- Accounting a little aggresive, lots of costs on intangibles (software & systems) are capitalised rather than expensed

Overall I think the market is too pessimistic on this stock, but how much is it really worth? Well I think this company can earn at least 10-15% return on equity over the cycle, so I think it’s worth at least 1.0-1.5x book value ($1.20-$1.80). The exact figure I’ll settle for will depend on the continued news flow from the company. I have initiated a small 1.4% position.

Disclosure: Author is long $LCM.ASX

Good write-up; thanks for writing it! I own Logicamms too, and for the same reasons you do.

I’m sorry to hear about your illness, Andy. Hope you’re able to get it under control soon.

Thanks again.