There were a few earnings announcements last week of interest so I wanted to go over them. The companies were Alibaba, AstraZeneca, Facebook, Apple and Weiss Korea Opportunity.

Alibaba IPO filing

Most tech IPOs, like Twitter and Facebook have sold at wild valuations so you may think I’m crazy for even bothering to look at Alibaba when the share price hasn’t even been set, and will likely be high. But I am interested, here is its filing.

The truth is, some companies deserve ridiculously high valuations. Those that can grow at high rates over a considerable period of time are worth a very high multiple of current earnings. Play about with my tool (no pun intended) and see what fair value growth rates of 30-50% give. You will soon find yourself in PE’s above 50.

Alibaba is a giant of the ecommerce world, accounting for 80% of China’s e-commerce. It consists of the following segments

Alibaba.com – the world’s largest business to business trading platform. It is incredibly hard for a new entrant to enter this market and build the network that Alibaba already has. It makes money by letting wholesalers pay for gold membership and better positioning in search results, but has no transaction fees on top.

Taobao – China’s Ebay, third most visited website in China. Again it is hard for new entrants in a market like this because of the existing userbase of Taobao. Unlike Ebay though, Taobao doesn’t charge transaction fees, instead it relies on advertising for revenue. Professional sellers can pay for more prominent placement as well. It does leave it open to a new future source of revenue though to start charging small transaction fees.

Tmall – T mall is like an online mall, brands purchase a “storefront” on the website to market and sell their products. It does not sell anything itself so doesn’t compete with clients. Clients pay a commission on sales of between 0.5 and 5% as well as an annual upfront fee.

AliExpress.com – this allows consumers around the world to purchase goods directly from wholesalers. It charges a fixed 5% commission on sales.

Financial results

The results pretty much speak for themselves; margins are good considering that for a lot of users, the services are essentially free, it’s hard to compete against that. Operating income has more than doubled every year.

Net income is only slightly below income from operations due to favourable tax residence and no leverage.

Price

We don’t know how the company will be valued but consider this. Yahoo owns just under a quarter of shares and has a market cap of $36bn. Ignoring Yahoo’s actual businesses, that means Alibaba is potentially valued at ~$150bn. For a company that made $3bn in 9 months, or $4.2bn annualised, that is a P/E of 36. I am going to say something I never thought I’d say but that is quite attractive. Don’t forget it is currently doubling profit or better every year. In just 2 more years of growth and no move in the share price that would turn into a P/E ratio of just 9.

AstraZeneca (LSE:AZN)

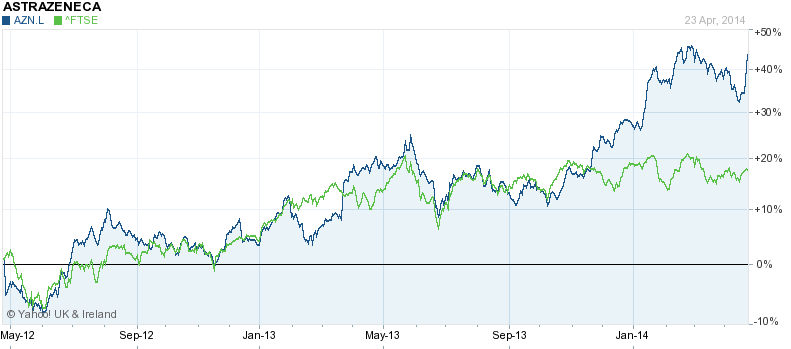

If you’ve ever screened the UK market for low P/E ratios and high returns on equity over the last few years, you will undoubtedly have had pharmaceutical giant AstraZeneca on your list. When I first came across it in 2011 its sales were dominated by around 5 blockbuster drugs which had impending patent expiries. Soon after it spent $13bn to acquire the drug pipeline of another company adding fuel to rumours that AZN itself had a very poor pipeline. I had no interest in taking a gamble on the pipeline so I passed even though it traded at single digit P/E ratio and a good dividend yield. Here’s the price action since, it has done quite well and beaten the FTSE 100.

When I first saw its latest results and that profits were down 16% excluding exceptionals I thought the patent expiries had finally come home to roost. But a closer look revealed revenues where actually slightly up Q on Q and that new drugs have been seeing very strong sales. I’m still not optimistic on AZN’s future, but maybe I’m biased because I interviewed for a job there years ago and they rejected me!

Facebook (NASDAQ:FB)

Everyone loves talking about how over-valued Facebook shares are (even me!), yet companies like Google and Amazon traded at these multiples over a decade ago and their growth has proved the owners right. Of course, not all tech companies prosper, but backing the right horse can be profitable even at wild valuations. FB’s latest results demonstrate that, revenues increased 72%! Net income tripled. The thing with high growth tech companies is that top line growth results in huge growth to the bottom line. Suddenly a 100 P/E turns into a 30 P/E in just one year, and then a 10 P/E if it continues. I’m not saying buy FB shares, but showing why I don’t now think they’re necessarily overvalued and would never short them.

Apple (NASDAQ:AAPL)

Except the iPod, I have never bought an Apple product in my life. They are more expensive and inferior to competitors, yet they sell in huge numbers. To me that shows one thing – a strong moat. For one of the biggest businesses in the world, it is also remarkably simple. The market is just waiting for Apple to release its next product at the moment, I’m pleased to see revenue and earnings up year on year despite no product innovations. At a P/E of 12.5 and with a huge cash pile on the balance sheet, it seems a fair price but if a new product launches and takes off it will soon become cheap.

Weiss Korea Opportunity Fund (AIM:WKOF)

Its first annual report has been released. I love this fund for three reasons, firstly the manager is competent and follows a shareholder friendly value investing methodology. Secondly, the Korean stock market is one of the most moderately valued in the world, yet it has access to the booming Eastern economies and will surely benefit from the long term strength there. Thirdly, this fund is a special situation, it is investing in preferred shares that trade at a 50% discount to the common despite having the same economic interests. I like it so much almost 10% of my portfolio is in it despite the fact it traded at a premium to NAV when I bought.

Disclosure: Author is long AAPL and WOKF and has no position in FB or AZN

re: Facebook

I can see why Facebook growth can continue. I just tried to restart my social networking and checked out Facebook, Twitter and Google plus. Everyone I know still on Facebook after 3 year absence. Google plus is completely dead. There is no competition for Facebook right now. It has a moat, only time will tell if it is a deep moat.