Summary: Collectors Universe has an Enterprise Value of $110m, and the companies free cash flow has averaged $10m over the last 4 years. It also boasts a 10% dividend yield. But what is most interesting about this investment is its competitive advantage. In a niche industry it is already a dominant player, with significant barriers to entry. The industry is likely to last for decades and will not become obsolete. Going forward the company is expanding internationally and potentially more than doubled its market by opening an office in China.

The Business

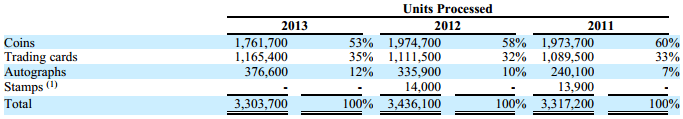

Collectors Universe provides authentication and grading services to dealers and collectors of high-value coins, trading cards, event tickets, autographs and memorabilia (“collectibles”). The authentication and grading services add value to these collectibles by enhancing their marketability and thereby providing increased liquidity to the dealers. Once they have authenticated and assigned a quality grade to a collectible, they encapsulate it in a tamper-evident, clear plastic holder, or issue a certificate of authenticity, that bears one of the brand names and logos: “PCGS” for coins, “PSA” for trading cards and event tickets and “PSA/DNA” for autographs and memorabilia. These secure cases are pictured below.

The company is currently number 50 in Forbes list of America’s best small companies and is one of the leading players in a niche industry which is highly dependent on brand name and the reputation of that brand. The fake memorabilia industry is huge, and services like Collectors Universe are essential for any serious collector as they need to authenticate their purchases and sales.

The three brands are:

- “PCGS” (Professional Coin Grading Service), est 1986, considered to be the best coin grading service around and trade at a premium to other graded coins

- “PSA” (Professional Sports Authenticator), est 1991, independent sports and trading cards authentication and grading service. This is a more controversial brand, with some accusing it of being easier for fraudsters to break into than competitors. Opinion is split though, some prefer it and it is popular, see this forum post for an example of how opinion is split.

- “PSA/DNA” (PSA/DNA Authentication Services), est 1999, which is the brand name for its independent authentication and grading service for vintage autographs and memorabilia.

Revenues are comprised principally of authentication and grading service fees. Those fees range from $4 to over $600 per item. Coins average revenue of $16.29 and trading cards $6.16. Third party verification is important, especially in the internet age where physical examination is not always possible. Sellers cannot authenticate items themselves as their incentives are not aligned with those of the buyer.

Although it has authenticated and graded over 26 million coins and over 21 million trading cards since inception, it believes that less than 10% of the vintage United States coins and trading cards have been authenticated and graded by independent providers. It plans to grow internationally, and opened an office in China in 2013 which has shown promising results and gives them access to a much larger market in coins.

The PCGS business also recently announced it is teaming up with eBay to expand the eBay U.S. and Canada coins catalog feature on its website. When the new catalog from PCGS goes online it will immediately grow from the current 8,500 products that they have to 41,000 products for coins revenue.

Financial Overview

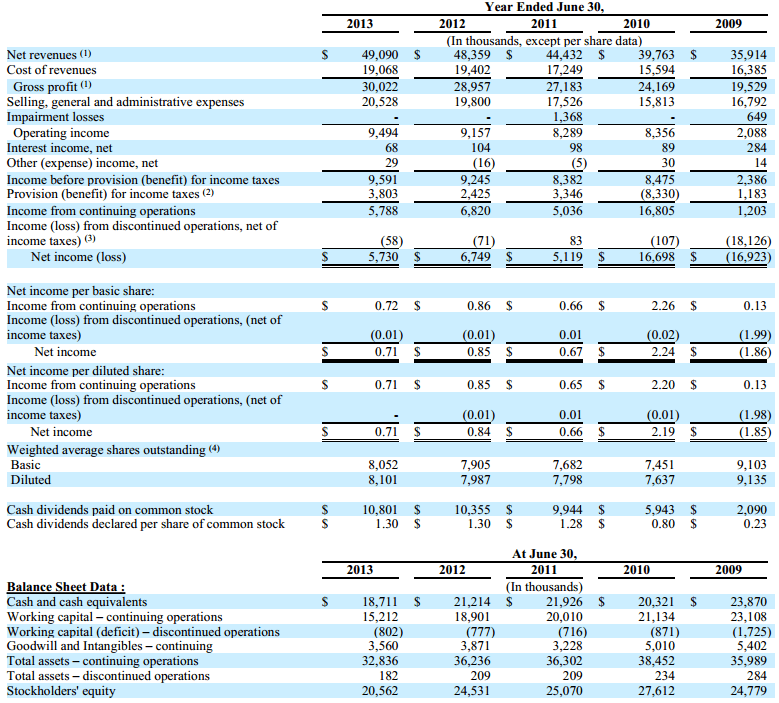

In 2013 Collectors demonstrated its brand strength, and pricing power, when it increased fees by 10%. Customers were not put off by the increases. The latest quarters results shows revenues have increased over 30% over last year.

Collectors’ reputation allows them to earn impressive net margins of 12.3% (TTM) and a Return On Invested Capital of 130% (average over 5 years). As you may expect, it is highly cash generative as a result and pays all of these cash flows out in dividends, giving it a current dividend yield of 10%. Its 5 year financials are below.

Revenues can be quite erratic, as the number and makeup of items to be appraised changes constantly and cannot really be predicted. One thing to note on its accounting practices is that it receives cash upfront, but only recognises revenue on completion of the grading and shipping of the object back to the customer. They also guarantee items they grade, which means if an item is found to be worth less than appraised, Collectors guarantees to purchase it at the appraised price. The effect on accounting is that they charge a ‘reserve’ for these guarantees to the income statement, but receive the cash up front. Hence cash flow regularly exceeds income.

This brings me onto the issue of the dividend, which at a yield of 10% actually exceeds income. The company enjoyed income tax relief over the last few years from losses carried forward but this has now ended. Many stock commentators expect a cut to the dividend and that may be why the stock has a large short interest. But I disagree for three reasons (this was also confirmed on the Q4 2013 conference call)

- The companies free cash flow is greater than earnings so actually covers dividends much better than earnings suggest

- The company has an $18m cash balance (and no debt) which covers shortfalls for the next 10 years based on recent cash depletion

- The company has a clear international growth plan, and 10 years is a long time to grow into a dividend

Management

I always like a company that has a management aligned to the interest of shareholders. The President (former CEO & Chairman) David Hall owns 11.4% of the company, and Duncan Richard Kenneth owns 10% but has been selling down his stake over the last few years.

In 2009 the board authorised a $10m share buyback program using some of its free cash, when the shares were at depressed prices. This reduced the share count by a huge 20% and clearly demonstrates management have shareholder interests at heart.

Another positive is that no stock options have been granted since 2007.

Risks

- The companies results are erratic, in the first 6 months of 2012 its operating income declined by almost 50% causing a large decline in the share price. The CEO was subsequently sacked. Although business has recovered now, a similar event could happen in the future.

- The company is somewhat affected by the price of precious metals. As gold for example gets cheaper, there is more interest from buyers of collectible coins so business improves. But they also then get less modern coins to appraise as sales from the US Mint fall. In a recent conference call management said that the business isn’t highly affected by these prices though.

- Chinese expansion is yet to be profitable but is early days. The company has a strong reputation, but revenue growth may not materialise as they expect.

- Mistakes could cost the company dearly, firstly through exercises of warranties (which inventory levels can be used to monitor – all inventory is purchased because of warranties), but also through loss of reputation which could be irreparable. Investors buying this company are paying a large amount of goodwill for the brand.

- The company relies on just two suppliers for its tamper evident clear cases.

- The collectibles industry is not currently regulated, but could be in the future.

Value & Conclusion

The Enterprise Value of the company is $110m, and the companies free cash flow has averaged $10m over the last 4 years. This was boosted by tax allowances which have ceased, but going forward the company is expanding internationally and potentially more than doubled its market by opening an office in China. At a 10% dividend yield investors are being paid to be patient but what is most important about this investment is the competitive advantage. In a niche industry it is already a dominant player, with significant barriers to entry. The industry is likely to last for decades and will not become obsolete.

The last thing I will note is that the company’s shares trade on quite low volume and the price is volatile. It has traded far below its current price in the last 12 months so I am hesitant to initiate a position. This is more to do with the fact that cash levels in my portfolio are low and I like to hold something in reserve in case prices of securities become very depressed. This stock is definitely on my watch list though, and if there is weakness in the price in the future I will be buying.

Disclosure: CLCT – currently no position

Thanks for putting this fascinating company into the limelight. I have one concern though: certification is *cumulative*. This limits potential growth significantly. To see the problem, consider the following (admittedly extreme) setting: The number of collectible coins is fixed (all historical coins essentially) and in the long run, 40% of the coins will eventually be certified. Given that “our” company has 10% market share and the main competitor 10% as well, this means the total amount of all coins they can be certified in the future is limited to the number they have already certified.

This — extreme — example would point a bleak picture to potential future business. Where am I wrong?

Yes it is a problem and one I had thought about. But given the company has been going for over 10 years, and that only 10% of the market is currently certified, I judged that the point at which it would be an issue will be many years in the future so probably wont affect the valuation that much.

Thanks for your reply. One point that may additionally limit the issue of limited growth is that the “universe of collectibles” will growth over time (coins that are current now will eventually become “collectible”) and new markets will be accessed (China etc).

I would suggest that there is not a fixed number of collectible coins for two reasons…

A). Every year new coins are minted. Believe it or not, new coins are sometimes graded, i.e. MS65 Silver Eagles.

B). Some coins are rated MORE than 1 time. Sometimes coins are taken out of their cases by thieves, relatives, or simply ignorant people…as the coin passes from owner to owner it eventually gets graded again.

Another example is “cracking” coins. Very valuable coins are sometimes resubmitted for grading if they are right on the edge of a grade. One step up in grading may result in a MUCH greater valuation. I’ve heard of coins being worth SEVERAL thousand dollars more if they move up one grade…so it is worth spending $40 or $50 if you think you have a legitimate shot at getting the higher grade.

I think the way to invest in this company is to put it on the watch list and try and snag it if it suddenly goes down…