Cambria Automobiles is a stock I have recently bought. It’s a retailer of new and used cars, commercial vehicles and bikes. It’s also engaged in the provision of vehicle servicing and related services. It operates through four segments: New Car, Used Car, After Sales and Internal Sales. Through its subsidiaries, it has over 30 dealerships, representing over 40 franchises and 10 brands. Its market cap is £60m.

The market is very pessimistic about their prospects with the economic uncertainty over the UK, so it trades at a forward P/E of just 6.4. It is “debt free” (cash covers debt, but seems like it’s needed for operations) and boasts an impressive ROIC of 22% (which the board actually monitors – important for an acquisitive company). Profits have more than doubled since 2011 and revenues have almost doubled. Like for like sales had been increasing until recently so this wasn’t all acquisition driven.

It operates on razor thin operating margins of 2%, but believe it or not this is quite good for the industry. The last poor year it had was in 2012 when the car market was difficult. Profits almost halved but rebounded the next year.

The company has good free cash conversion, and net profits seem to be a good proxy for cash flow to owners. It does spend this cash acquiring more car dealerships, having spent £25m doing so over the last 3 years. It was established in 2006, with £10m, and has done well to build such a business through one of the most difficult economic periods. They are increasingly going for high end, luxury dealerships now, mostly Jaguar Land Rover.

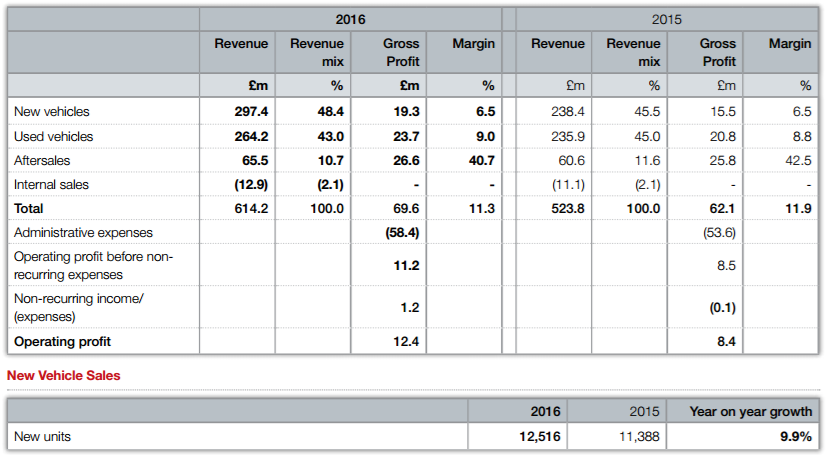

The most recent earnings update had like for like sales down in new cars, and slightly ahead in used cars and services. I think this is the reason for the market’s pessimistic outlook, yet management said they still expect to meet market expectations. We’ll see. This is the company’s revenue split last year. I note that new car sales are the least profitable.

The company often references UK car registration statistics. I hunted these down here, as they probably give a good overview of how the car market is doing in general. The latest release shows car registrations very strong for what it’s worth. The latest forecast is for a 5% drop in new car registrations due to the impact of the sterling devaluation.

Vertu Motors ($VERTU:LN) is another car dealership, though larger, which the market is similarly pessimistic about. It only manages operating margins of 1% and much smaller ROIC of 12%. It trades at a forward P/E of 6.7.

I like the management of this company. From the 2012 Annual Report, Chairman’s address:

“Crucially we have continued to remain faithful to our objective to minimise the creation of goodwill on acquisitions, but recognise that we may pay goodwill for the right opportunity”

They seem to have their priorities in the right place. The company is quite young, having started just before the time of the financial crash, so it is a testament to their management and business model that they have done well in a difficult time.

I have opened a position in CAMB, it now makes up 3% of my portfolio. I think it’s worth a closer look.

Very interesting idea. Thanks for posting!