Today I finally closed one of the most frustrating positions in my portfolio for a profit, Goldplat (GDP:LN). This company has been a continual disappointment throughout the 6 years I’ve held it, repeatedly running into operating problems which turned a profitable business into a loss making one in recent years.

Goldplat is not (just) a gold miner. Most of its operations are recovering gold from waste products. As such, I originally thought of it as a useful hedge against economic meltdown, as it benefits from a rising gold price, but also can (in theory) make profits during low gold price periods too.

That, at least, turned out to be true. The current turmoil coupled with a nice half year operating update announcing it had sold its loss-making mine meant this business finally almost reached my valuation this week.

My exit & why

I bought GDP in two tranches. The first in March 2014 made 27% profit for me, or 3.8% annualised, and the second in July 2014 made 84% profit, or 10.6% annualised (averaging down worked for once). Nothing to get either elated or depressed about, but I can’t help but wonder whether I got lucky with this one.

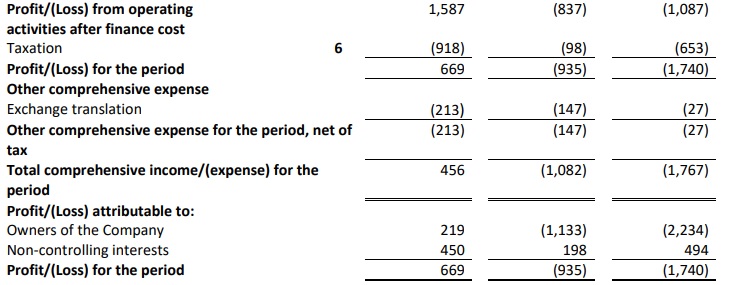

One thing I realised only after a couple of years of holding it, was that the company isn’t as profitable as its management make it out to be. There is no massaging of figures (that I’ve seen), but they simply focus on operating profit mostly in their communications. Now this is very useful, but using it for valuation (even accounting for other costs and tax) was a mistake I made because I hadn’t realised the size of non-controlling interests. Take a look at this from their latest set of results:

The figures at the top show how the operating businesses are doing, but look how much of that profit has gone when you get down to “Owners of the Company”.

A £1.6m operating profit in the first half of the year, or £0.7m net profit, makes the company’s £13m market cap look reasonable. But when compared to a £219k profit, not so much.

The selling of their mine does offset this somewhat, but even then I think the company is at best reasonably valued, and at worst, overly optimistic.

So I’m not comfortable with my original valuation, and am just glad to be out of this business. I’m sitting at 27% cash and am thinking I’ve missed my chance to increase position sizes in the big tech monopolies like Facebook and Alphabet. I’ll have to look out for other opportunities.

Disclosure: Author has no position in GDP:LN. Author is Long GOOGL and FB.

1 thought on “A shrewd exit, or dumb luck?”