Mathematics is often thought of as a difficult subject, and as a graduate of Mathematics I can certainly testify to its complexity at a high level and at times mind-boggling abstractness. Investing requires mastery of very few Mathematical concepts, and those are mainly simple ones such as percentages and annualized growth rates. But the danger in Mathematics is not from a persons inability to use more advanced techniques, it is from a failure to comprehend the true implications of deceptively simple concepts. Here are some interesting examples of how simple Math can yield unexpected results.

Puzzling Probabilities

I’m going to start this article off with one of my favorite Math questions:

On a game show there are three doors. Behind one door is a car, and the other two is nothing. You must choose a door to find the car. After choosing, the game show host instead of revealing your choice, reveals one of the other doors as having nothing behind it and then asks if you would like to switch your choice to the remaining closed door. What should you do?

At this point you may think it obvious that it is now a 50:50 chance so it doesn’t matter what you do, but that is incorrect. This is a simple sounding problem but needs more thought to solve than it would initially seem. If you were offered a choice of the two doors from the outset it would indeed be a 50:50 chance, but you actually picked a door when the odds were 1 in 3. Those odds do not change because one of the doors is revealed. Think of it this way, if instead of revealing one of the doors, the host asks if you would like to keep your single door, or instead choose both the other doors. Then it is clear you should switch. But this question is equivalent to the original one, the only difference being the host confirmed which door had nothing. Hence you should always switch.

Future earnings con

So let’s move onto some mathematical deceptions more relevant to the investing world; Investors love growth, especially these days when loss making tech companies command eye-watering valuations. The intrinsic value of a company is the sum of all its future cash flows, discounted to the present day with a suitable discount rate. Investors often use Discounted Cash Flow models to estimate the value of a company.

For this question I will use an example. Take two companies, Tech-Co and Bore-Co.

Tech-Co is a hot new company growing revenues at 50% per year. It currently makes no money, being funded mainly with debt, but in 5 years time its growth phase will be over and it will be earning a stable profit margin of 5%. Hence its future earnings will start in 5 years time and be flat thereafter.

Bore-Co makes boring products for consumers, say pencils, at a 5% profit margin also. Its market share is large and doesn’t grow, but its earnings grow at around 3% per year in line with inflation, which will continue forever.

Let’s assume both companies currently have revenues of $2bn. Which one is worth more?

Try to avoid picking an answer based on what type of message you think I will be trying to send. Instead really think about the Math and which you think will earn the most.

If you picked Bore-Co, you’re wrong. And not just slightly wrong, you are completely off the mark. Tech-Co is worth $5.2bn at a 10% discount rate, whereas Bore-Co is worth less than a third of that at $1.5bn. In fact Bore-Co would have to grow at 8% forever to reach a valuation higher than Tech-Co.

The truth is that short/medium term earnings and growth are a lot more important than the long term in a DCF model, mainly due to the discounting mechanism. Even though Tech-Co has 0 earnings for the first 4 years, at 50% growth it soon far outstrips the profits of Bore-Co.

This is particularly applicable to retirement planning. Those who save early in their lives for retirement can often contribute nothing after 10 years and still have a pension pot larger than someone that started older but contributed for 30 years.

I like this example because for most value investors we know the value of long-term compounders, but can underestimate the power of short term growth.

Discount rate conundrum

Staying on the DCF theme: Investors usually spend a long time analyzing a company’s growth prospects, the market they operate in and their earning power. These are the core inputs into a valuation or DCF model, and even small variations have large impacts.

But despite all this effort, investors often use a standard discount rate of say 10% (of which I am admittedly one) and put little thought into it. Yet this too can have dramatic effects on valuation. Take Bore-Co above that was valued at $1.5bn at a 10% discount rate and lets change the discount rate to 9%. A seemingly insignificant decrease, yet one that increases its value by almost 20% to $1.7bn.

If instead we think Bore-Co is a bit risky and discount by 12% then this wipes out over 40% of its value.

Over the last 5 years we have seen unprecedented low interest rates. If you adhere to the classical theory that discount rates should be ‘risk-free’ rates plus a premium, then we should have been reducing discount rates in our models. That makes it easy to see why stock indices in the West have been soaring yet (in my opinion) this does not constitute a ‘bubble’, it just reflects the interest rate environment.

I don’t claim to have an answer to what investors should do about such sensitivity to discount rates other than be aware of it.

The company earnings pattern

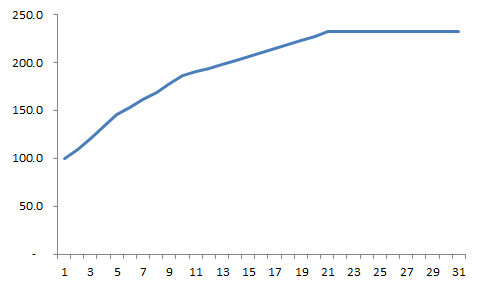

This example isn’t so much a mathematical deception, but more of a human perception fallacy. Again on the subject of discounted cash flow models, investors usually forecast a company’s earnings in a pattern similar to this

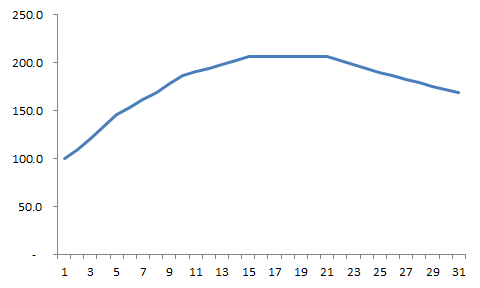

But in reality a company’s sales and earnings often resemble a pattern similar to this

Think about many of the large (non-cyclical) companies around today and try to name some that have seen sales growth consistently for 30 years or more. You will find a lot of them have completed various acquisitions in order to grow sales but if you look at a specific segment over the long term, at some point they will usually go into decline.

It is the nature of consumers, they often get bored with products, or an innovative competitor enters the market and steals market share. Even giants like Gillette or Coca Cola are not immune to this. In the past, population growth has meant earnings growth for most companies is sustainable. But Western populations aren’t in growth anymore; excluding immigration they are mostly in decline.

The good news is that the ‘future earnings con’ I talked of above makes the ‘tail end’ of the earnings graph have a smaller impact on the final valuation, but investors should still be cautious when assuming a company’s sales will be flat or increase forever.

Final thoughts – on ‘Valuation Ratios’

I’ll end with perhaps the most important example (I do like to reward readers motivated enough to read an entire article!). Take two companies, A and B that have growth rates of 5% and 10% respectively and currently have the same earnings. Most people would say company B is more valuable than company A so if I said A was trading at a P/E ratio of 15 and B at a P/E ratio of 10 you would probably choose B as the best investment. B clearly has the better PEG ratio (the most useless ratio in the known universe in my opinion). Well, I would say you don’t have enough information.

Those of you that have been in the investing world a while may have thought the same, and the most obvious omission from the P/E is debt. Ah but the obvious answer to that problem is the beloved EV / EBITDA ratio. So lets modify the question: both companies A and B have no debt and EV/EBITDA ratios of 10 and 5 respectively. Ok, now you may think that B is clearly the best investment. But I say it is still too little information.

The truth is that relying on simple ratios like P/E, or EV/EBITDA or whatever, can be deceptively attractive. There are problems with comparing companies on basic ratios like these. The two main problems are:

Free cash flow: Company A could be collecting its entire net income as free cash flow, and its 5% growth rate is organic. Whereas B may have negative free cash flow, as all cash is being reinvested in the business to achieve 10% growth. The intrinsic value of a business is the sum of its free cash flows in the future i.e. not including reinvested earnings (which should be reflected in the growth forecasts). Hence A may be a more attractive investment despite higher P/E and EV/EBITDA ratios.

Acquisitions: Even free cash flow is not enough to properly assess a company. Both A and B could also have identical free cash flow, but A may return this to shareholders whereas B uses it to buy other companies. Suddenly B’s 10% growth doesn’t look so attractive as the underlying business may not be growing at all. When modelling earnings you should either adjust growth or adjust free cash flow to make sure acquisitions aren’t artificially inflating the valuation.

I hope these examples and all in the article will prove useful to you when assessing investments in the future.

Hi Andy,

Great article. Do you have any issues with the comparison of ROCE/ROIC to cost of capital and inferring something about the company’s valuation or competitive advantage?

Interested to get your thoughts.

High ROIC can definitely give you an idea of competitive advantage and I try to avoid companies that have a low ROIC. But I’ve learnt the hard way that ROIC alone doesn’t guarantee competitive moat. For example Tesco had one of the highest ROICs in its industry yet sales started to decline and that high ROIC soon turned average.

http://investingsidekick.com/buffett-wrong-tesco/

I try to look for more qualitative reasons for advantages now.

In that game with doors it seems to me that AFTER the host showed me the door with no car I can flip a coin to choose one of the other doors and the expectancy of finding a car will be 50%.

Sorry, now I get it, staying with previously chosen door is clearly inferior with 1/3 chance. But that coin toss would be on par with picking the other door, dont You think?

Not quite, because a coin toss is 50:50 but here the odds are 2:1 that you chose wrong in the first place. The host revealing the empty door doesn’t change the odds because he knowingly chose the empty door to reveal, so you are in effect utilizing his insider info when you switch.

Out of the 2 in 3 chance you chose wrong initially he has effectively put that 2 in 3 chance all on the remaining door by revealing which one of the others is empty.

Yeah You right, thanks for clearing that for me.

Could you elaborate a little on the Bore-Co and Tech-Co example of finding the actual value of both?

For Bore-Co for example, i thought that 2 bn revenue with 5% profit margin would equal yearly earnings of 0,1 bn. As inflation and revenue growth (and therefore earning growth) equal each other out, can we disregard it?

Then 0,1 bn would be 1 bn with a discount rate of 10%?

Hi Alex

Yes I started at $100m earnings, but I valued it in nominal terms, so I included the 3% as a growth rate, which summed to infinity works out at $1.47bn

(sum of geometric series: 100/(1-1.03/1.10) – 100)

Ah, ok. Thanks for the explanation. I thought you would deduct the inflation. Thinking as the WACC would be the assumed interest on top of inflation. But like this I understand.

Great article. Keep on the good work. Just found your blog. Looks very interesting. I hope to find articles on case studies in your blog with regard to the last part (EV/EBITDA and free cash flow). But up to now it looks promising.