Games Workshop (LSE:GAW) is a company that I have had my eye on for a while. My brother is a big fan of their table top Warhammer fantasy games, and at one point I played the Warhammer Online game, so I am well aware of their products, and how loyal their fan base is. After a shock fall in sales for the first half of the year, and a failure to declare a dividend, the share price has plummeted 25% so the shares may offer good value.

The business

Games Workshop manufactures and sells models collected and used by hobbyists in table top combat simulations under the Warhammer and Warhammer 40k brands. It is a fantasy game where the customer buys a model, and then has to assemble and paint the models themself, which is part of the hobby. Customers will assemble hundreds of these models to create an army, and battle this army against other enthusiasts according to a set of rules that the company itself sets out.

The company also operates a lot of its own retailers where it sells exclusively Warhammer material. There are facilities at the shops, or model ‘battlefields’, where customers congregate to play the game.

Customers invest a lot of time and money in building an army so have no wish to switch to competitors (if a serious one existed) once they’ve stared. This gives them a high customer loyalty. Also the popularity of Warhammer means that it is easy to find others that want to play with you, which creates significant barriers to entry in this market.

Computer games in general haven’t really had any major negative effects on the business, and in fact it makes money by licensing the brand to game developers who make Warhammer computer games.

Management

The chairman owns around 6% of the company and has been in post for decades. I am impressed with his focus on the firm’s profitability and return on capital and that sales growth is not seen as something to pursue at all costs. Return to shareholders has been a prime focus and almost all free cash is paid out in dividends. This has meant the share price has remained somewhat fully valued for a while now, unfortunate for us value hunters.

The latest annual report gives a good insight into the thinking of management and it is worth reading the Chairman and CEO’s commentary. It is also worth reading the Chairman’s report from when the business was last struggling, it was unusually honest.

“We grew fat and lazy on the back of easy success. We forgot about customer service and forgot that hard work is and always has been the route to success. We forgot that we are a company which pursues profit and likes paying surplus cash to its owners. What was not expected was that it would take two poor years and a management reorganisation to get the problems taken seriously. Somewhere along the line too many of us thought that selling, sweating and saving were someone else’s job. Well they aren’t. That’s my job and the job of all of us here at Games Workshop.”

Financials

Here is a tearsheet showing a 5 year financial history of the company. GAW has a long record of sales growth but not without its share of difficulties.

|

|

Profits have been fast growing over the last 5 years as margins have expanded dramatically but this cost cutting has finally taken its toll. In its latest interim report the company says sales have fallen due to reducing staff at its stores and reducing the opening hours.

Such problems can be easy to reverse, but whether there is any lasting damage from this in terms of customer loyalty we can’t really say at this moment. It doesn’t indicate it will reverse the staff cuts.

The company has earned an impressive return on investment between 45% and 50% over the last few years which is a testament to management’s turnaround. It also means the business requires little capital investment to grow.

Revenues still down on 2004

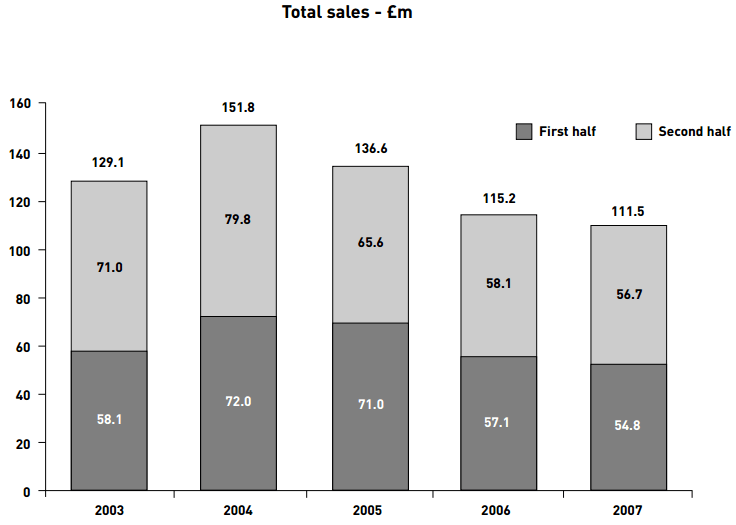

The graphs above show a surprising story for such a strong company though, revenues peaked in 2004 and now, 10 years later (was that really 10 years ago!?) revenues are still not where they once were.

The chairman is adamant that computer games have not impacted the business but I have to disagree. As a once avid computer gamer myself, I know the year 2004 stands out for one reason: World of Warcraft.

Late 2004/ early 2005 saw the launch of what would become the giant of online gaming and the fantasy gaming genre. Boasting over 12 million paying subscribers at its peak it was (and still is) completely dominant in the Massive Multiplayer Online (MMO) industry and there is a large similarity between the Warcraft universe and the Warhammer universe.

I don’t find it a coincidence that sales suffered dramatically in 2005 and have still not returned to those levels. World of Warcraft (WOW) is far cheaper, and much more engrossing than table top games.

But that is history now, the MMO genre is now far more mature and fragmented and has surely stolen all the customers it can from Warhammer. I don’t see another industry disrupter like this on the horizon. Mobile gaming, for one, does not require the time investment that the old WOW game did.

3D printing and counterfeits

Warhammer has done quite well to avoid counterfeiters damaging its business. Due to the extremely detailed models they produce it is highly unlikely for forgeries to be accepted by customers. All manufacturing is done in Nottingham, England. The company implies it has enquired overseas, possibly in the far east, to find a cheaper supplier but found none that can produce the level of detail they need without excessive capital investment.

One worry I do have though is in 3D printing. I am in no way knowledgeable about this technology, but it seems to me if they can print things like pens, then an unpainted plastic model should be a piece of cake. It doesn’t seem much of a stretch to think the technology will eventually allow the detail they need too and provide people an easier way to counterfeit GAW’s models. It is one to watch in my opinion.

Valuation

The companies long term sales growth record is impressive, but over the last 5 and 10 years less so. I think it would be unreasonable to expect profit margins to continue to improve given the sales impact these cost cuttings are now making. If the company can return to, and maintain the operating margins it has had over the last few years then it could earn around £15m in profits per year, likely to slowly increase over time as the firm has decent pricing power.

A lot of this profit comes through as free cash flow, over the last 5 years FCF/Net profits has been 135% (i.e. it takes in more in free cash flow than reported as profits) so this means it should generate roughly £20m in FCF per year. Compared to its current market cap of £175m that looks quite attractive.

But we can’t ignore the recent slump in sales and profits, the latter of which fell by 30%. I don’t think this is a long term trend for a few reasons. Firstly because management gave a decent explanation of why it happened and what they can do about it. Secondly, because inventory and trade receivable levels don’t appear to have increased disproportionately, which are usually an indication of deeper rooted problems.

However if profits do remain 30% lower, then FCF will instead be around £14m putting it on a P/FCF ratio (excluding cash) just under 12. That appears quite fair to me for a company with a good, loyal customer base.

Situations like this often remind me of other retailers though. Two I have owned, Deckers Outdoor (NASDAQ:DECK) and Supergroup (LSE:SGP), both of which I made money on, but both of which had I invested on the first announcement of sales problems would definitely have lost me money.

For that reason I am hesitant to initiate a position in GAW so soon after these problems have arisen. More problems tend to follow all too often, and this in my opinion is one of the situations where patience is rewarded.

Disclosure: GAW – no position

Random GW fan. To be honest I wouldn’t invest in GW. I love their products but the community of Gamers has been shrinking since 2004. IMO there are four reasons for this; a lack of community support and communication (no official forum, no Facebook or Twitter account, etc), competition (WoW/video games, other Wargaming companies such as Privateer Press, Mantic, etc), an angry fanbase and increased prices (books required to play their games cost 150% more, models have increased 25-100% more in cost but have less miniature components and lower quality since 2004).

If you want to see how their customers feel about GW just Google Games Workshop and take a few minutes to read through fan forums also look up “employee reviews of GW”. IMO the emploeyees and exemployees of GW illustrate GWs problems more concisely than online fan forums do. Also look up a non GW store that carries GW products and have a discussion with that store’s owner, managers, employees and customwrs about GW and you won’t like what you hear if you’re investing in GW.

Lastly their customer base is shrinking at an alarming rate. They will not hit 2004 levels again because they no longer have a monopoly on the wargaming community. This year they are coming out with two new systems Age of Sigmar and Warhammer 30 K so it might boost up their numbers temporarily but GW isn’t going to do better in the long run unless they become better at communicating and interacting with their consumers. Shiny novelty games will only stave off the inevitable temporarily. Everyone who is into Wargaming knows that GW is hosed. Maybe not in the next few years but their long term prospects don’t look good.

Oh and I am a consumer of theirs since 2003. The company is a different beast now and they have totally lost touch with us. I have four armies and I want them to do well but I can see their current direction will run them aground unless they do an about face soon (as in the next 5 years). If they don’t they’ll be doomed to mediocrity if not eventual bankruptcy..