One of Warren Buffett’s most successful investments was in American Express, just after the ‘Salad oil scandal‘ hit. A company had been faking inventory to receive loans secured against it, and American Express was one of the casualties when the scam was uncovered. The stock plunged 50% and allowed Buffett to secure a strong growing business at a cheap price. Higher One (NASDAQ:ONE) is a financial services company offering debit card accounts and electronic payment facilities targeted at HE institutions and students. It is being hit with its own set of scandals which leaves the stock trading at a forward P/E ratio of just 7 despite returns on equity of 15% (which have historically been much higher at ~30%).

The business

Before I get into the scandals, first we need to understand how Higher One makes money. I will confess, as a UK resident, I have no experience of the US college system or Higher One, but this is what I have gathered from the filings and anecdotal evidence. Tuition reimbursement is an important thing to understand, my understanding is that students pay tuition fees up front and then get reimbursed throughout the year either by an employer, the government or some other sponsor. Some of these “refunds” are made to the HE institution which then has to disperse them to students. Historically this was done with paper admin and issuing checks. Higher One offers colleges the software and a service to manage this for them. It also offers students ‘OneAccount’s, branded as Higher One but provided by a partner bank, and it markets these as an option into which these refunds can be made. It highlights the advantages of choosing this option, such as faster receipt of funds. Revenue is derived from fees the company charges on the financial transactions it facilitates. These fees vary in amount and type for each segment:

Revenue is derived from fees the company charges on the financial transactions it facilitates. These fees vary in amount and type for each segment:

HE Institution revenue: This segment relates to the software and services it supplies to colleges, and colleges will pay annual fees as well as some transactional fees too. This service allows them to send invoices automatically to students, both receive electronic payments and send refund payments to students, all whilst keeping records and eliminating the need for time consuming paper records. It can also set up individual payment plans for each student. This is a very strong moat business, once a college is using the service and software it will most likely stick with it. The segment has a 98% retention rate on customers. 600 campuses covering 5 million students use this already.

Payment transaction revenue: These are fees from payment plans set up by students and parents, or electronic payments for tuition made through their system.

Account Revenue: This is the largest segment by revenue and relates to the fees and charges the company collects in relation to an individual student’s OneAccount. These fees vary from automatic charges when going overdrawn to fees for using another banks cash machines, or using the debit card with PIN to make a purchase (only signature is free). A full list of the current fees can be found here.

The Scandal

The company is accused by the Federal Reserve Bank of Chicago of violation of the Federal Trade Commission Act in relation to marketing and disclosure on its OneAccount. The criticism is that colleges are incentivized to push college campus debit cards onto their students, even if they are high in fees. These incentives are of the form of revenue sharing or even cash payments to the colleges. It is also criticised for apparently opening accounts for students and depositing funds without their knowledge, meaning they have no choice but to use the account. There is precedent for this type of legal action, in 2012 Higher One made an $11m settlement with FDIC over unfair and deceptive practises with relation to its accounts. In 2013 it made another settlement of $15m in a class action lawsuit over “predatory marketing”. Here is a quick excerpt from the settlement with FDIC.

“The FDIC determined that Higher One operated its student debit card account program (OneAccount) with The Bancorp Bank in violation of Section 5. Among other things, the FDIC found that Higher One and The Bancorp Bank were: charging student account holders multiple nonsufficient fund (NSF) fees from a single merchant transaction; allowing these accounts to remain in overdrawn status over long periods of time, thus allowing NSF fees to continue accruing; and collecting the fees from subsequent deposits to the students’ accounts, typically funds for tuition and other college expenses.”

The Government Accountability Office (GAO) has looked into this issue and actually found that fees for Campus Debit cards were ‘comparable with those of mainstream banks’ with a couple of exceptions like Higher One charging for using a PIN to make purchases as opposed to signature. There is talk of a government sponsored debit card solution to fee reimbursement which would be a big blow to Higher One, it is unclear how many students would continue to use a OneAccount if it isn’t tied with fee reimbursement.

Most worrying of all though is this disclosure from Higher One in its last quarterly filing.

“Any administrative order arising out of this matter is likely to include demands for material customer restitution, material civil money penalties, and changes to certain of our business practices and could have a material adverse effect on our business, financial condition and results of operations. Although the ultimate amount of restitution or civil money penalties are subject to many uncertainties and therefore are impossible to predict, it is possible the amounts could reach levels that would cause an event of default under our Credit Facility. While we believe that it is probable that we will have a loss related to this regulatory matter, in view of the inherent difficulty of predicting the outcome of regulatory matters, we cannot predict what the eventual outcome of this pending matter will be, what the timing of the ultimate resolution of this matter will be or the potential range of loss associated with this matter.”

The other side

Every debate has two sides. This article does a good job of giving a balanced view on the issue and accuses politicians of trying to score points to improve their public perception. Yale, the respected US college, has publicly praised Higher One, despite not being a customer and its only vested interest is the company was founded by a Yale student.

The company also maintains it previously settled law suits to avoid lengthy and costly litigation, not because it is at fault – although this stance is weakened by its removal of specific charges and fees since the verdicts.

Higher One has 2 million student customers with accounts and it has been rising every year despite the negative press coverage. Perhaps students don’t think they are being scammed and actually think its a decent account. Of course with so many customers there will be complaints and accusations, VISA for example regularly spends lots on legal costs, it comes with the territory of highly regulated environments.

The GAO report presents a strong case for the company that its products are actually competitive, at least now even if not so in the past.

There is also fresh blood at the top of the company. Marc Sheinbaum was recently made CEO, and was previously the CEO of the Auto Finance and Student Lending business at JPMorgan. This unit had over 5,000 employees and $53 billion in auto loans in 2013. Prior to this, Marc spent 15 years at GE in its consumer finance business ultimately serving as the CEO and President of GE Money Services. Marc has experience in navigating complex regulatory matters within consumer finance and doesn’t seem like the kind of person that would tarnish a strong career by leading a dodgy company into its inevitable bankruptcy.

Recent performance

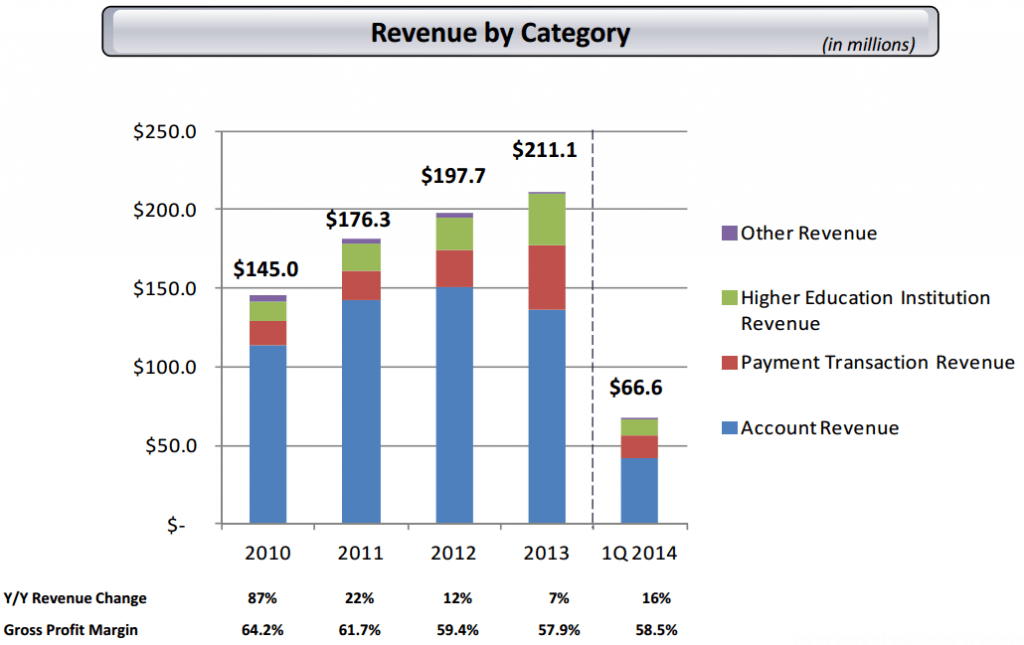

Total revenue was 16% higher in the first quarter of 2014 compared to the first quarter of 2013. Payment transaction and higher ed revenue continued to be the drivers that led to higher results over 2013. The large portion of the increases in revenue came from the acquisition of Campus Solutions last year. Gross profits however were down, driven by the inclusion of the Campus Solutions business and declines in revenues from the OneAccount which were high margin. The declines in revenue were due to removal of certain fees – actual number of accounts continues to grow. Net profit has also been falling further due to increased legal expenses and new debt taken out for the acquisition which now leaves the company with net debt of $92m.

Conclusion

As an outsider it is hard for me to determine the public pressure on the company or its reputation at large. Most of my readers live in the US and can hopefully shed some light on this. From what I have researched however this looks like it could present an attractive investment opportunity, but one that I can’t buy for my portfolio as I don’t feel I know enough about the company’s reputation or the likelihood of a destructive legal outcome. Also I would caution anyone interested to be mindful of the company’s warning on the debt default, these kind of warnings aren’t given out lightly.

Disclosure: Author has no position in ONE.

Are you aware of any competition in this space? For such a profitable business model, one would expect new entrants to follow.

I’d be very careful with that investment. To answer the competition question – they provide some type of service to 13 million of the 20 million higher education students in the United States and serve 1,900 of the 4,000 higher education institutions. Roughly 5 million students are enrolled at institutions that use Higher One for loan disbursement.

The biggest issue is not the short term liquidity problems or legal settlements that are pending. The biggest issue is the Neg-Reg negotiations that just concluded. The regulatory changes that are proposed would not allow Higher One to contact a student prior to the student making a choice on how they would like to receive their loan disbursement. This change in regulation could be the kiss of death for Higher One because the adoption rate on their OneAccounts could drop dramatically. The adoption rate is approximately 40% and that might drop dramatically given the regulatory changes.

The business environment that allowed Higher One to grow rapidly and dominate this market no longer exists and the relationships they have with higher education institutions will change if the adoption rate of the OneAccounts drops significantly.

Thanks for the reply Chris, this is exactly the reason I didn’t invest in this, without living in the US it is too easy for me to miss something going on in the political landscape. I was aware of the new regulations from the filings but obviously it’s more serious that the company makes it appear.

Bowen, there are competitors in this space, Higher One has the largest market share with something around 30% if I remember, so someone is obviously getting the remaining 70%. There is an article here that lists Sallie Mae, Nelnet and Blackboard as competitors http://www.insidehighered.com/news/2011/09/02/new_entrants_in_financial_aid_refund_business#sthash.aHqsmlgj.dpbs