I reviewed my portfolios performance over the first half of 2013 here, so now lets look at the second half.

In the second half the portfolio returned 30.8% beating both the S&P 500 at 15.4% and FTSE All share at 11% (both including dividends). I am pleased with the performance this year, which has totalled 50.5%. I wouldnt have expected to beat the market by such a margin in what has been quite a frothy year, with a lot of companies selling at full or over-valuations. I am also reluctant to give myself a pat on the back as there are many companies I didn’t pick that also did well, it was a good year to be a small cap investor.

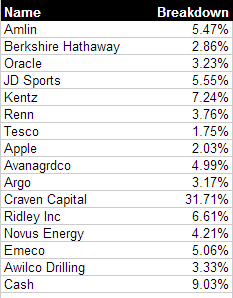

This is what the portfolio now looks like at the end of 2013.

During the second half I sold positions in Deckers Outdoor, IBM, and reduced my position in Amlin. The Craven House Capital position now dominates the portfolio and is up 73% since I bought, but this is not the sole driver of my performance

Excluding Craven House the rest of the portfolio is up 11.3% overall, this was driven by roughly 65% increases in JD Sports and Kentz. Novus Energy also yielded a quick return of 41% on a takeover announcement, so I dont think any further gains are likely.

There have been some disappointing performances though, Argo and Tesco continue to perform poorly, although Argo has a large dividend to make up for it. My newer positions in Emeco and Awilco Drilling haven’t moved much in share price but havent done well in terms of currency. These are unhedged, unlike my CAD and USD holdings so I realise any losses.

Cash is at 9%, I sort of wish it was higher, but there is nothing I want to sell at this point. Renn Trust should be giving a cash return to shareholders soon this year and Awilco Drilling also pays a large dividend so that should provide some cash going forward.

Outlook (picks for 2014)

A lot of my portfolio is trading at much higher valuations than when I purchased so isnt necessarily good value for a new entrant in my opinion. But some holdings are. Despite its increase, Craven House is still undervalued, and I will sell once it reaches the 1.25p mark, over double its current share price. Oracle, Ridley, Emeco, Argo and Awilco all still offer compelling value in my opinion and these are the ones I would expect to do the best in 2014. I have covered these on the site before so wont go over the theses again.

I would be surprised if we had another year of high returns in the stock market in 2014, I’d probably prefer to have more cash because of this but conversely I am happy that my portfolio will do well even in a down market. I still see a margin of safety in my holdings and the possibility of returns to be reasonable over the long term.

Congratulations on an excellent performance. I am very curious about your holding in Craven Capital and look forward to reading more comments on this company in your blog.

Thanks.

Its an interesting company, and with only £2m or so market cap is of little interest to anyone but the smallest investor which is why I think such a great opportunity exists.

Its starting to dominate the portfolio though, up to 40% now and if it ever hits my price target it would probably be pushing 60% so I’ll aim to lighten up on it at some point, maybe if it hits book value.